The Weekly Update

Week of April 10th, 2023

By Christopher T. Much, CFP®, AIF®

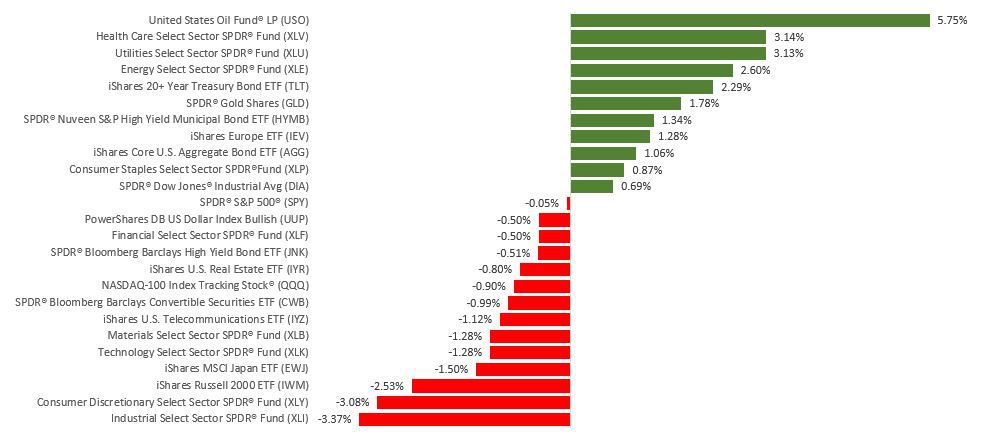

Stocks ended a shortened week of trading mixed amid revived recession fears on Wall Street triggered by weak economic data.

The Dow Jones Industrial Average gained 0.63%, while the Standard & Poor’s 500 slipped 0.10%. The Nasdaq Composite index lost 1.10% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced +0.37%.

Recession Fears Resurface

Renewed recession worries dented investor sentiment, and the week kicked off with a weekend announcement by OPEC+ nations of their intention to cut oil production.

The prospect of higher oil prices not only revived inflation fears, possibly hurting the chances of a rate-hike pause by the Fed, but it raised concerns over future consumer spending. Stocks weathered the news well but buckled on weak manufacturing and services data in subsequent days. Stocks trended lower again after a lower-than-expected open-jobs number and a slowdown in private-sector hiring.

Stocks stabilized to close on Thursday, despite an increase in jobless claims and a pick-up in March layoffs.

Cooling Labor Market

A string of labor reports last week reflected signs of a cooling labor market, beginning with an unexpectedly significant decline in the number of open jobs (falling below 10 million for the first time in nearly two years). The JOLTs report preceded payroll processor ADP’s employment report that saw a rise in private sector hiring of 145,000 (short of the consensus forecast of 210,000) and smaller wage gains.

After reports of a jump in initial jobless claims on Thursday and a 15% rise in layoffs in March, Friday’s March employment report showed the smallest increase in nonfarm payrolls (+236,000) since December 2020.

This Week: Key Economic Data

Wednesday: Consumer Price Index (CPI). FOMC Minutes.

Thursday: Jobless Claims. Producer Price Index (PPI).

Friday: Retail Sales. Industrial Production. Consumer Sentiment.

Source: Econoday, April 7, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Thursday: Delta Air Lines, Inc. (DAL)

Friday: JPMorgan Chase & Co. (JPM), Blackrock (BLK), UnitedHealth Group Incorporated (UNH), Citigroup, Inc. (C), The PNC Financial Services Group, Inc. (PNC)

Source: Zacks, April 7, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.