The Weekly Update

Week of April 5th, 2021

By Christopher T. Much, CFP®, AIF®

Overcoming a rocky start, stocks rallied into the close of a holiday-shortened week of trading as technology shares staged a powerful recovery and investors reacted positively to President Biden’s infrastructure spending proposal.

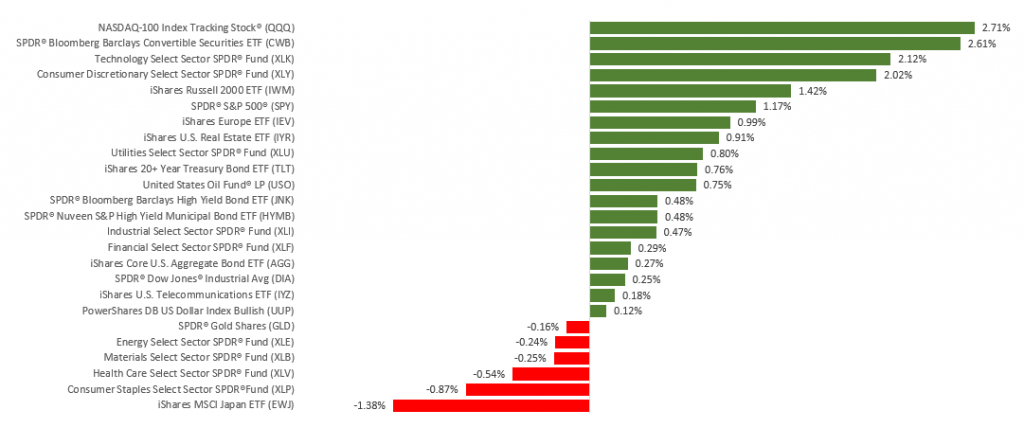

The Dow Jones Industrial Average gained 0.24%, while the Standard & Poor’s 500 picked up 1.14%. The tech-heavy Nasdaq Composite index rose 2.60%. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.43%.

S&P 500 Hits 4,000

Monday opened with two banks reporting they face losses due to the default of a small U.S. hedge fund. That news, combined with rising yields, higher new cases of COVID-19, and a public warning of new virus variants, started the week off on an unsettled note.

Despite the shaky start, upbeat economic reports helped spark a rally that was paced by gains in the technology sector. The market also reacted positively on Wednesday to the introduction of a $1.9 trillion infrastructure proposal.

Stocks closed out the week with an exclamation mark, with the S&P 500 Index closing above 4,000 for the first time.

Hedge Fund Woes

Last week’s trading opened on news that a U.S.-based investor was forced to unwind positions in multiple Chinese technology companies and American media holdings.

A number of large banks saw their share prices fall early in the week, reflecting concerns about their exposure to the hedge fund losses. Meanwhile, investors grappled with whether this was a one-off event or the opening act for additional hedge fund issues. As the week wore on, it appeared the hedge-fund issues were an isolated event.

This Week: Key Economic Data

Monday: Factory Orders.

Tuesday: Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims.

Source: Econoday, April 1, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Paychex, Inc. (PAYX).

Thursday: Constellation Brands (STZ), Conagra Brands (CAG).

Source: Zacks, April 1, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.