The Weekly Update

Week of January 18th, 2022

By Christopher T. Much, CFP®, AIF®

Deteriorating investor enthusiasm for high-valuation growth companies and a mixed start to the fourth-quarter earnings season made for a volatile week.

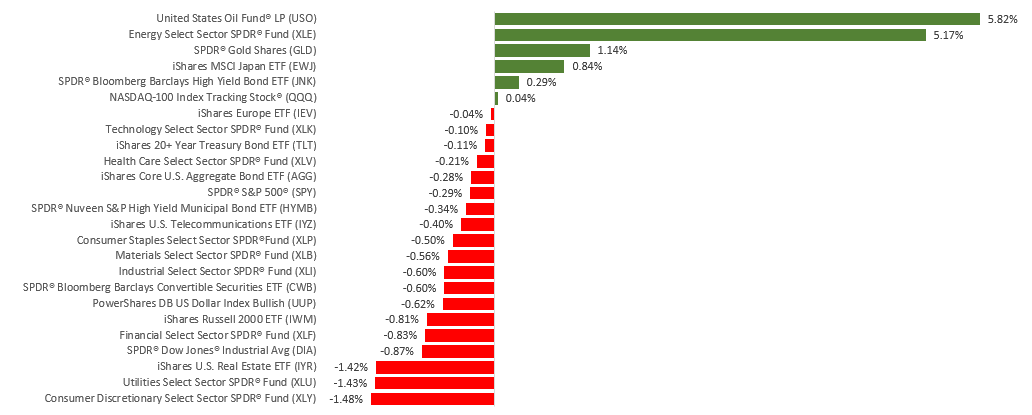

The Dow Jones Industrial Average lost 0.88%, while the Standard & Poor’s 500 slipped 0.30%. The Nasdaq Composite index fell 0.28% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.31%.

Stocks Struggle

Stocks were under pressure all week as investors grappled with higher bond yields and talk of possibly four rate hikes this year. Initially, intraday declines would bring out buyers and pare the losses. Investors were particularly heartened by Fed Chair Powell’s congressional testimony on Tuesday that softened the hawkish tone found in the minutes of the Federal Open Market Committee’s December meeting.

After digesting the hot inflation reports released mid-week, stocks were unable to resist the selling pressures on Thursday. A weak retail sales number, a resumption in the rise in yields, and mixed earnings from some of the big money center banks weighed on the market during Friday’s trading.

Inflation and the Fed

Inflation reports last week continued to reflect upward momentum in consumer prices. The Consumer Price Index posted a 7.0% year-over-year jump–the biggest increase since 1982, while the Producer Price Index rose 9.7% from a year earlier–the fastest pace since 2010 when the index was reconstituted.

Markets responded calmly as both numbers were in the neighborhood of expectations and the monthly increase for each moderated from previous single-month increases. The price pressures are expected to remain in the face of continuing supply chain constraints and wage growth. The pace and persistence of price increases may influence the speed at which the Fed may tighten in the year ahead.

This Week: Key Economic Data

Wednesday: Housing Starts.

Thursday: Jobless Claims. Existing Home Sales.

Friday: Index of Economic Indicators.

Source: Econoday, January 14, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The Goldman Sachs Group, Inc. (GS), The Charles Schwab Corporation (SCHW), J.B. Hunt Transport Services, Inc. (JBHT)

Wednesday: Bank of America (BAC), UnitedHealth Group, Inc. (UNH), The Procter & Gamble Company (PG), Morgan Stanley (MS)

Thursday: Netflix, Inc. (NFLX), CSX Corporation (CSX), Union Pacific Corporation (UNP), United Airlines Holdings, Inc. (UAL)

Friday: Schlumberger Limited (SLB).

Source: Zacks, January 14, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.