The Weekly Update

Week of March 12, 2018

By Christopher T. Much, CFP®, AIF®

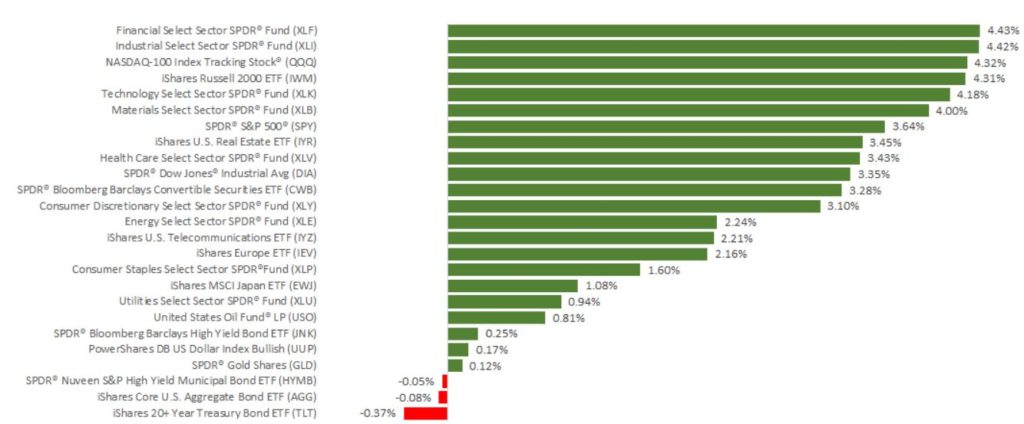

Domestic stocks leapt ahead last week as the latest jobs report inspired renewed confidence in our economic standing. The S&P 500 added 3.54%, and the Dow gained 3.25%. The NASDAQ erased its losses from February’s market correction to hit a new record close while growing 4.17% for the week. International stocks in the MSCI EAFE increased by 1.79%.

In addition to solid stock growth, Friday, March 9, also brought a significant milestone in the markets: the 9th anniversary of our current bull market. The Dow is now amid its longest-ever bull run, and the S&P 500’s bull market is its 2nd-longest and -largest ever.

To put the recovery in perspective, 9 years ago, the S&P 500 closed at only 676.53. By market’s close last Friday, the index was at 2,786.57—more than 4 times its value at the bull market’s start.

What drove last week’s market performance?

While talk of tariffs on aluminum and steel imports affected stocks last week, a major jobs report was arguably the biggest market mover. The Bureau of Labor Statistics released its latest jobs report on Friday, and the numbers relieved many investors’ inflation concerns. The data showed that the economy added 313,000 jobs in February—far more than what analysts expected.

At the same time, wages only grew by 2.6% from this time last year, below the prediction.

What does this data mean?

Bloomberg called the labor report a “‘Goldilocks’ scenario,” because it indicates that the economy is neither too hot nor too cold. The data reveals that many people are returning to the workforce, but wages are not increasing fast enough to trigger significant inflation.

This jobs report also contrasts with last month’s data, which showed wages rising faster than expected. That report contributed to February’s market correction.

Ultimately, some analysts believe the latest data implies that inflation is less of a concern, and the Fed may only increase interest rates 3 times this year.

Later this month, Federal Reserve leaders will meet to determine whether to raise interest rates and will also provide their latest economic projections. Looking ahead, we will continue to analyze the interplay between labor, inflation, and interest rates—and how these forces may affect your financial life.

ECONOMIC CALENDAR:

Tuesday: Consumer Price Index

Wednesday: Retail Sales

Thursday: Jobless Claims, Housing Market Index

Friday: Housing Starts, Industrial Production, Consumer Sentiment