The Weekly Update

Week of June 17, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

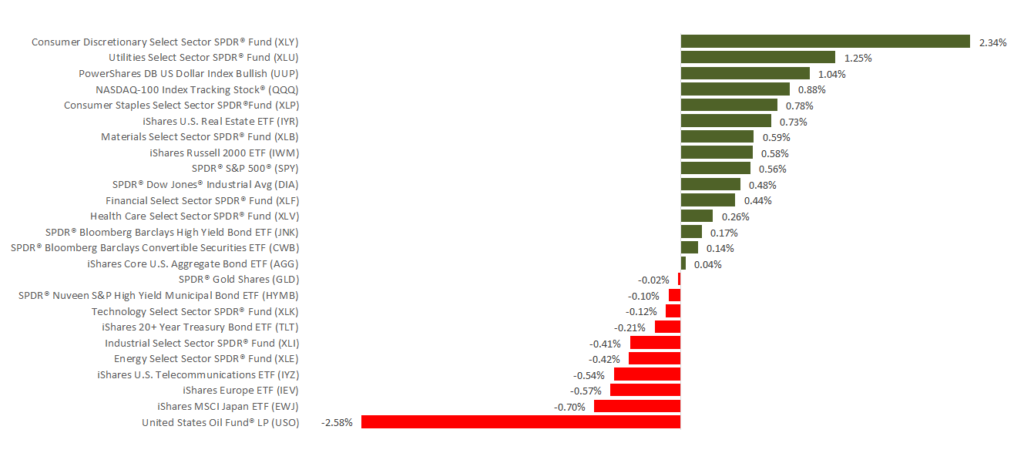

Stocks advanced for a second straight week. The S&P 500 benchmark rose 0.47%; the Nasdaq Composite, 0.70%; the Dow Jones Industrial Average, 0.41%. Overseas shares, as tracked by the MSCI EAFE developed markets index, added 0.20%.

The market seemed to put its recent preoccupation with trade issues aside, with attention shifting to this week’s Federal Reserve monetary policy meeting. Traders in futures markets now believe the Fed will make a rate cut in July, so its June policy statement will be of great interest.

Oil Prices Rollercoaster

Attacks on vessels in the Strait of Hormuz, the busy oil shipping channel, helped to push the price of West Texas Intermediate crude 2.2% higher Thursday, just a day after a 4% fall. Even so, WTI crude lost 2.7% in five days, closing Friday at $52.51 on the New York Mercantile Exchange.

Investors wondered at mid-week if tensions in the Persian Gulf region would soon impact oil output and transport. Looking beyond the short term, however, the International Energy Agency reduced its 2020 projection for global oil demand.

Households Bought More in May

Retail sales rose 0.5% last month, according to the Department of Commerce. Across the year ending in May, they advanced 3.2%. The previously announced 0.2% April retreat was revised into a 0.3% gain.

These numbers affirm strong household spending this spring. Consumer spending accounts for roughly two-thirds of the nation’s gross domestic product.

What’s Ahead

In terms of news, Wednesday offers what may prove to be the biggest economic event of the week: a Federal Reserve policy statement and press conference.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The Federal Reserve concludes a 2-day policy meeting, with Fed chair Jerome Powell addressing the media afterward.

Friday: The National Association of Realtors releases data on May existing home sales.

Source: Econoday / MarketWatch Calendar, June 14, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Jabil (JBL)

Wednesday: Kraft Heinz (KHC), Oracle (ORCL)

Thursday: Kroger (KR), Red Hat (RHT), Darden Restaurants (DRI)

Friday: CarMax (KMX)

Source: Zacks.com, June 14, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.