The Weekly Update

Week of March 29th, 2021

By Christopher T. Much, CFP®, AIF®

A rocky week with wide price swings led to mixed results for stocks last week, as investors grappled with anxieties over economic growth and weakness in technology and other high-growth stocks.

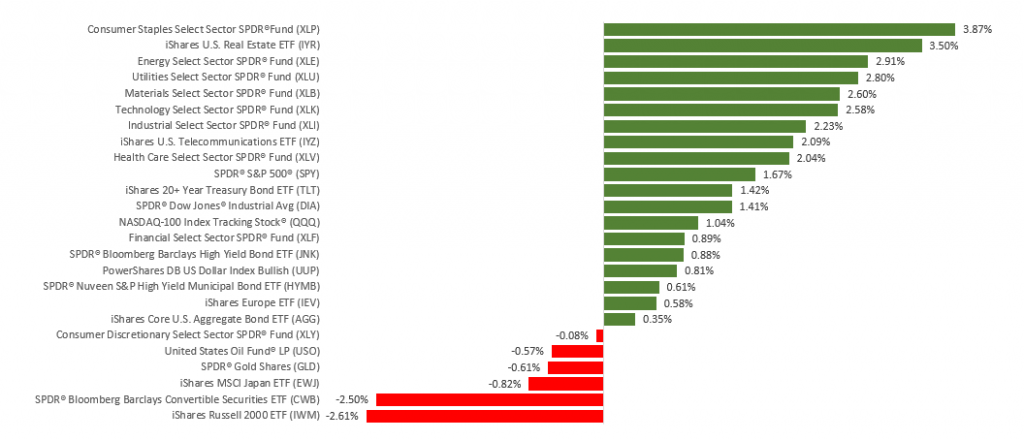

The Dow Jones Industrial Average added 1.36%, while the Standard & Poor’s 500 gained 1.57%. The Nasdaq Composite index fell 0.58% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 1.67%.

Stocks Churn

After a promising start to the week, stocks turned negative on mounting concerns about economic growth in Europe, with broad losses in energy, cyclicals, and technology.

Though bond yields backed off their highs and Secretary of the Treasury Janet Yellen and Fed Chair Jerome Powell both struck an optimistic tone on the economy, stocks posted back-to-back losses on Tuesday and Wednesday.

Thursday trading was emblematic of the week’s volatile action. The S&P 500 dropped nearly one percent earlier in the day following Powell’s comment about the Fed eventually rolling back its bond purchase program, then rallied to close with a 0.5% gain.

Stocks rallied into the Friday close, pushing the Dow and S&P 500 into positive territory and paring the losses on the Nasdaq Composite.

Tech Remains Under Pressure

The losses in technology and other high-growth stocks in recent weeks have largely been attributed to the sharp and rapid rise in bond yields.

So, it was both interesting and a bit confounding that last week saw yields pull back, and rather than helping support these companies’ stock prices, many technology stocks continued to decline. The failure to rally on lower yields may be pointing to other reasons for their price weakness. Some are concerned about current prices and believe there may be better growth opportunities in more fairly valued companies. The “fear of missing out” that propelled investors to pile into these stocks over the last twelve months appears to have moderated.

This Week: Key Economic Data

Monday: Consumer Confidence.

Tuesday: Consumer Confidence.

Wednesday: ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims. ISM (Institute for Supply Management) Manufacturing Index.

Friday: Employment Situation Report.

Source: Econoday, March 26, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Lululemon Athletica (LULU), Chewy, Inc. (CHWY).

Wednesday: Micron Technology, Inc. (MU), Walgreens Boots Alliance (WBA).

Thursday: Carmax, Inc. (KMX).

Source: Zacks, March 26, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.