The Weekly Update

Week of February 27th, 2023

By Christopher T. Much, CFP®, AIF®

Concerns over a firmer monetary policy were heightened by fresh economic data, touching off a climb in bond yields and a slide in stock prices last week.

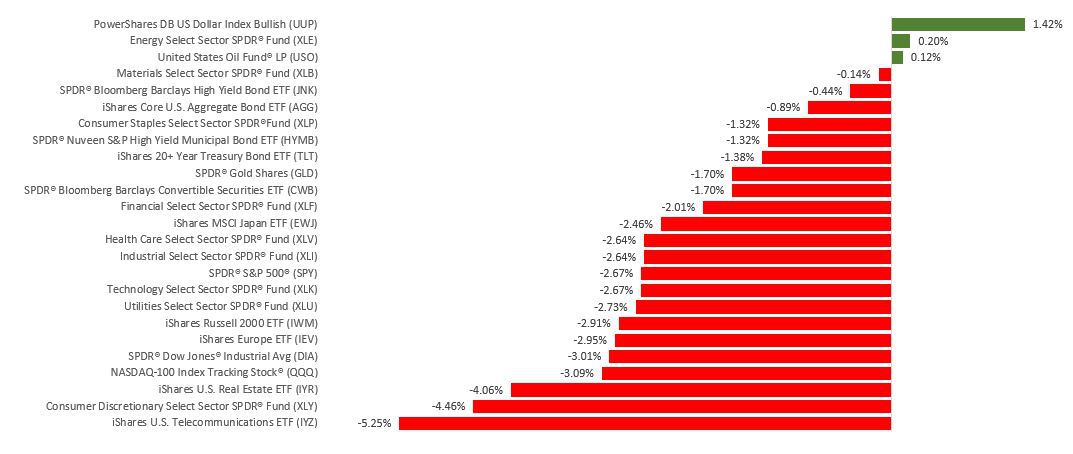

The Dow Jones Industrial Average skidded 2.99%, while the Standard & Poor’s 500 dipped 2.67%. The Nasdaq Composite index sagged 3.33% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, retreated 1.23%.

Stocks Slide

Stocks struggled last week, buffeted by growing fears of further Fed tightening and disappointing forecasts from two major retailers that called into question the consumer’s health. The release of the minutes from the Federal Open Market Committee’s (FOMC) last meeting did little to assuage investor worries. Reflecting these concerns of a more aggressive Fed was that by Thursday, traders were pricing in a 27% chance that the Fed might lift rates by a half-percentage point at its next meeting, far above the 1.3% chance just one month ago.

Stocks took another leg lower on Friday following the release of January’s Personal Consumption Expenditures (PCE) price index, which showed hotter-than-expected price increases and more robust consumer spending.

FOMC Minutes

Minutes from the last FOMC meeting indicated that nearly all members agreed with February’s quarter-point rate increase, though some would have supported a 50 basis point rate hike to move quicker towards the Fed’s target range. While the minutes suggested another 25 basis point hike is likely at their next meeting, investors remain anxious that more recent economic data may prompt a 0.50% hike instead.

The minutes stressed that inflation was still too high. However, members diverged on the economy, with some members finding the risk of recession elevated. In contrast, others feel the Fed may engineer a soft landing or avoid a recession altogether.

This Week: Key Economic Data

Monday: Durable Goods Orders.

Tuesday: Consumer Confidence.

Wednesday: Institute for Supply Management (ISM) Manufacturing Index.

Thursday: Jobless Claims.

Friday: Institute for Supply Management (ISM) Services Index.

Source: Econoday, February 24, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Workday, Inc. (WDAY).

Tuesday: Occidental Petroleum Corporation (OXY), Target Corporation (TGT), AutoZone, Inc. (AZO), Ross Stores, Inc. (ROST), Agilent Technologies, Inc. (A).

Wednesday: Salesforce, Inc. (CRM), Lowe’s Companies, Inc. (LOW), Dollar Tree, Inc. (DLTR).

Thursday: Broadcom, Inc. (AVGO), Costco Wholesale Corporation (COST), Best Buy Co., Inc. (BBY), Marvell Technology, Inc. (MRVL), Dell Technologies, Inc. (DELL).

Source: Zacks, February 24, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.