The Weekly Update

Week of November 28th, 2022

By Christopher T. Much, CFP®, AIF®

Growing optimism that the Fed may be ready to ease future interest rate hikes sent stocks higher in a quiet trading week.

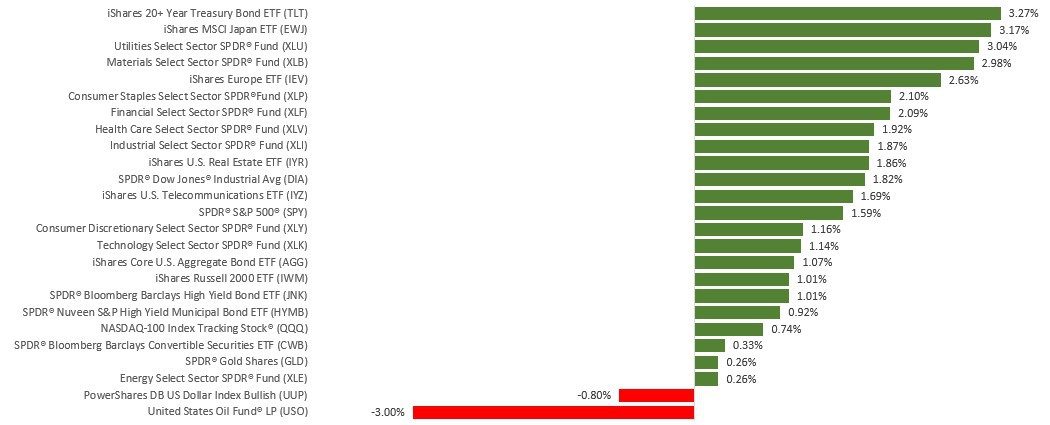

The Dow Jones Industrial Average gained 1.78%, while the Standard & Poor’s 500 added 1.53%. The Nasdaq Composite index improved 0.72% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.33%.

Stocks Rally

In light holiday-week trading, stocks rallied as investors grew more hopeful of a slowdown in a future rate hike. The release of the minutes from the early November meeting of the Federal Open Market Committee (FOMC) fed investors’ optimism. Fed officials suggested such easing may be coming soon.

Investor sentiment was also lifted by unexpectedly strong retailer earnings, upside surprises in new economic data, and a better-than-expected consumer sentiment reading. Investors looked past the continuing Covid-related challenges that have stymied China’s economic recovery and its attendant implications for global growth.

Easing In The Offing?

The Fed meeting minutes, released before the Thanksgiving holiday, showed that most Fed officials felt a slowing in interest rate increases would be appropriate. The minutes also suggested that such a deceleration in rate hikes may begin with December’s meeting with a 50 basis point hike rather than a fifth consecutive boost of 75-basis points.

The primary reasons for slowing the pace of rate hikes were the growing risk that the Fed may increase rates beyond what was required to reduce inflation to its two percent target and signs that inflation pressures were easing.

This Week: Key Economic Data

Tuesday: Consumer Confidence.

Wednesday: Gross Domestic Product (GDP). Automated Data Processing (ADP) Employment Report. Jobs Openings And Labor Turnover Survey (JOLTS).

Thursday: Jobless Claims. Purchasing Managers’ Index (PMI) Manufacturing.

Friday: Employment Situation.

Source: Econoday, November 25, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Workday, Inc. (WDAY), Intuit, Inc. (INTU), CrowdStrike (CRWD).

Wednesday: Salesforce, Inc. (CRM).

Thursday: Marvell Technology, Inc. (MRVL), Dollar General Corporation (DG), The Kroger Co. (KR).

Source: Zacks, November 25, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.