The Weekly Update

Week of March 25th, 2024

By Christopher T. Much, CFP®, AIF®

Stocks posted their best week of the year, sparked by news that the dovish Fed decided to keep rates steady and signaled three rate cuts were still possible this year.

Stocks Bounce Back

As widely expected, the Fed left rates unchanged at the conclusion of its two-day meeting. But somewhat less expected, the Fed signaled its inclination to cut interest rates three times this year—each time by a quarter percentage point. That was a positive surprise for some, who worried that recent hot inflation reports would cause the Fed to reconsider its stance.

Markets pushed higher on Wednesday following the news, with all three averages closing at record highs. The rally continued through Thursday, boosted further by news that existing home sales rose 9.5 percent in February.

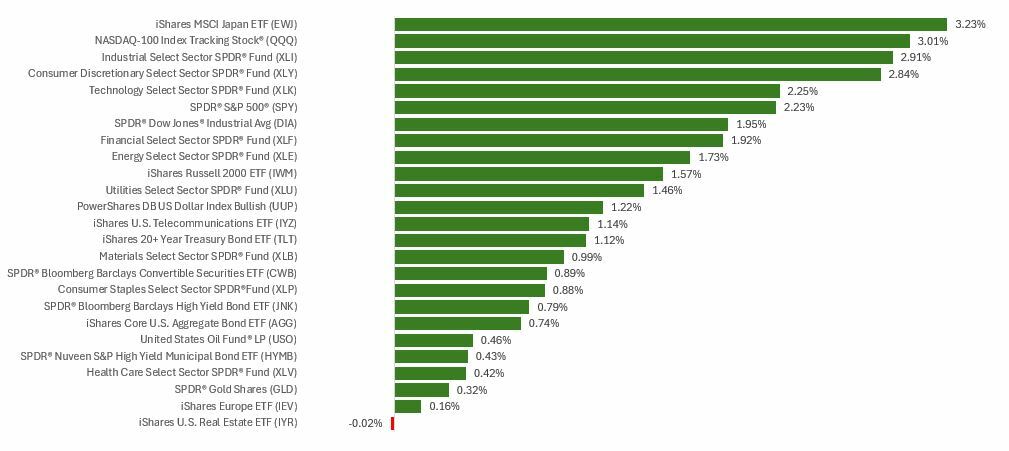

The week’s rally was broad-based overall, with 10 of the 11 S&P 500 sectors posting gains (health care dropped slightly). At one point late in the week, nearly one in four S&P 500 stocks were trading at 52-week highs. That was the highest proportion in three years, which supports the idea that the rally was broadening out from mega-cap tech stocks.

Turning Point

The Federal Open Market Committee’s decision marks a turning point as the Fed signaled that its target range of 5.25 to 5.50 percent has topped out. That target range, in place since late last year, is the highest level in 23 years.

“We believe that our policy rate is likely at its peak for this type of cycle,” said Fed Chair Powell at the post-meeting press conference. He added that if the economy keeps on its current course, that the FOMC would likely “begin dialing back policy restraint at some point this year.” If the FOMC votes to ease it at its June meeting, it would be the first cut in four years.

This Week: Key Economic Data

Monday: New Home Sales.

Tuesday: Durable Goods Orders. Case-Shiller Home Price Index.

Wednesday: EIA Petroleum Status Report. Survey of Business Uncertainty.

Thursday: Gross Domestic Product. Jobless Claims. Consumer Sentiment. Pending Home Sales.

Friday: Personal Income and Outlays. International Trade in Goods. Retail Inventories.

Source: Investor’s Business Daily – Econoday economic calendar; March 18, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: McCormick & Company, Incorporated (MKC, MKC.V), Dave & Buster’s Entertainment, Inc. (PLAY)

Wednesday: Paychex, Inc. (PAYX), Carnival Corporation (CCL, CUK), Cintas Corporation (CTAS)

Thursday: Walgreens Boots Alliance, Inc. (WBA)

Source: Zacks, March 19, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.