The Weekly Update

Week of April 8th, 2024

By Christopher T. Much, CFP®, AIF®

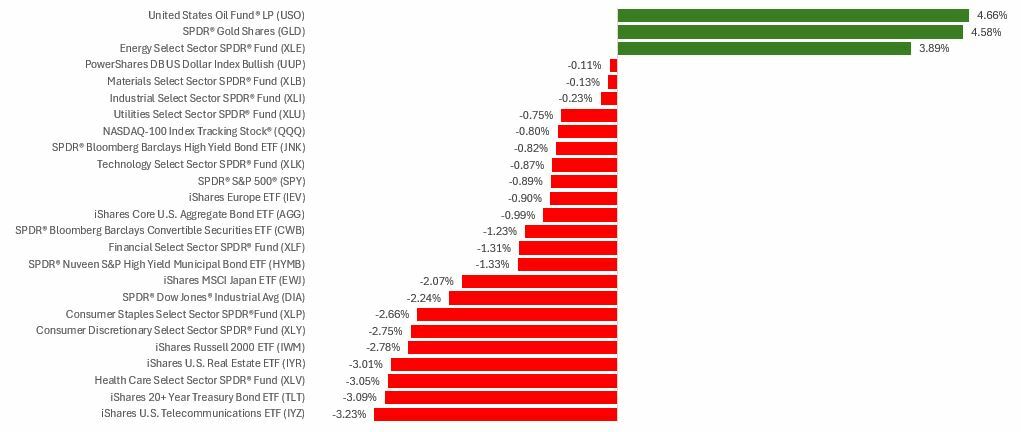

Stocks dropped last week as investors focused on “what’s next” for interest rates after mixed comments from multiple Fed officials.

Fed Officials Weigh In

Stocks struggled out of the gate again last week, ending Monday and Tuesday in the red on concerns that recent economic data could derail the Fed’s plan for short-term rates.

The markets recovered Wednesday through Thursday morning when weekly jobless claims were better than expected. But stocks fell broadly Thursday afternoon following mixed comments from multiple Fed officials. All three averages ended the day down more than 1 percent for the first time in a month.

On Friday, a strong jobs report gave investors much-needed confidence. The U.S. economy created 303,000 jobs in March—higher than economists’ expectations—while unemployment dropped slightly to 3.8 percent. Markets rallied after the news, but not enough to recoup all weekly losses.

What’s The Scoop?

Several Fed officials made speeches last week, including Chair Jerome Powell. In a Wednesday speech at Stanford University, Powell said it was a “bumpy” path to a soft landing, but Fed officials are continuing to look at the long-term trends.

Last week, Atlanta Fed President Raphael Bostic suggested one cut. San Francisco Fed President Mary Daly noted no guarantees, and Cleveland’s President Loretta Mester said rate cuts may come later this year. Minneapolis President Neel Kashkari rattled markets by suggesting that no cuts may be on the table, followed by Fed Governor Michelle Bowman, who said on Friday that it’s possible rates may have to move higher to control inflation.

The flurry of comments comes following the end of the Fed’s blackout period. Fed officials are not allowed to make public comments except for very narrow windows during the year.

This Week: Key Economic Data

Tuesday: NFIB Small Business Optimism Index.

Wednesday: Consumer Price Index (CPI). FOMC Minutes. EIA Petroleum Status. Treasury Statement.

Thursday: Jobless Claims. Producer Price Index—Final. Fed Balance Sheet. EIA Natural Gas Report.

Friday: Import and Export Prices. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; April 2, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Albertsons Companies, Inc. (ACI)

Wednesday: Delta Air Lines, Inc. (DAL)

Thursday: The Progressive Corporation (PGR), Infosys (INFY), Constellation Brands Inc (STZ)

Friday: JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), BlackRock, Inc. (BLK), Citigroup Inc. (C), State Street Corporation (STT)

Source: Zacks, April 2, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.