The Weekly Update

Week of April 22nd, 2024

By Christopher T. Much, CFP®, AIF®

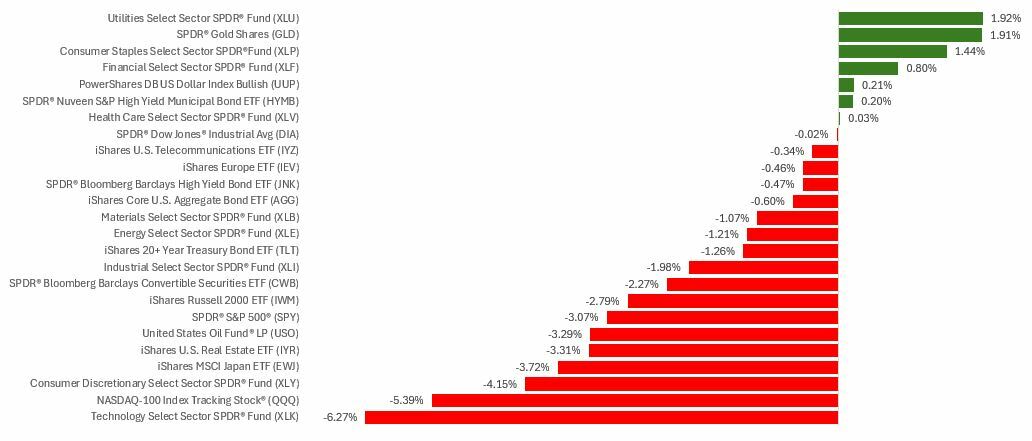

Stocks fell for a third straight week, as Fed Chair Jerome Powell’s mixed but upbeat message could not offset the anxiety caused by the Middle East conflict.

Stocks Retreat

Markets began the week rattled by further escalation in the Middle East over the weekend. A bit of good news punctuated an otherwise sour Monday, as a stronger-than-expected retail sales report showed consumers were spending despite rising inflation.

On Tuesday, remarks from Fed Chair Jerome Powell indicated a shift in thinking—from being confident to not-so-confident about interest rate cuts in 2024. He said rates might need to stay higher until the Fed meets their 2% inflation target.

On Friday, the markets saw further declines, but investors were somewhat reassured by the perception that Thursday’s retaliatory actions in the Middle East were restricted in scope.

Silver Linings

When stocks are in a downtrend, it’s important to keep perspective and realize that markets move in cycles. Here are a couple of bright spots from last week and perhaps some good news that may influence trading in the week ahead:

While Chair Powell said last week that the Fed may keep rates higher for longer, he also said the Fed does not intend to raise rates for now.

Despite inflation concerns, individuals were in a spending mood in March. Retail sales increased 0.7% for the month, more than twice the consensus forecast.

“Earning season” picks up during the next four weeks. For the week ending April 26, more than 800 companies will give updates on business conditions in Q1.

This Week: Key Economic Data

Tuesday: PMI Composite. New Home Sales.

Wednesday: EIA Petroleum Status Report. Durable Goods. Survey of Business Uncertainty.

Thursday: Gross Domestic Product (GDP). International Trade in Goods (Advance). Jobless Claims. Pending Home Sales.

Friday: Personal Income & Outlays. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; April 18, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Verizon Communications Inc. (VZ)

Tuesday: Tesla, Inc. (TSLA), Visa Inc. (V), PepsiCo, Inc. (PEP), GE Aerospace (GE), United Parcel Service, Inc. (UPS)

Wednesday: Meta Platforms, Inc. (META), International Business Machines Corporation (IBM), AT&T Inc. (T), The Boeing Company (BA)

Thursday: Microsoft Corporation (MSFT), Alphabet Inc. (GOOG, GOOGL), Merck & Co., Inc. (MRK), T-Mobile US, Inc. (TMUS)

Friday: Exxon Mobil Corporation (XOM), Chevron Corporation (CVX)

Source: Zacks, April 18, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.