The Weekly Update

Week of May 6, 2018

By Christopher T. Much, CFP®, AIF®

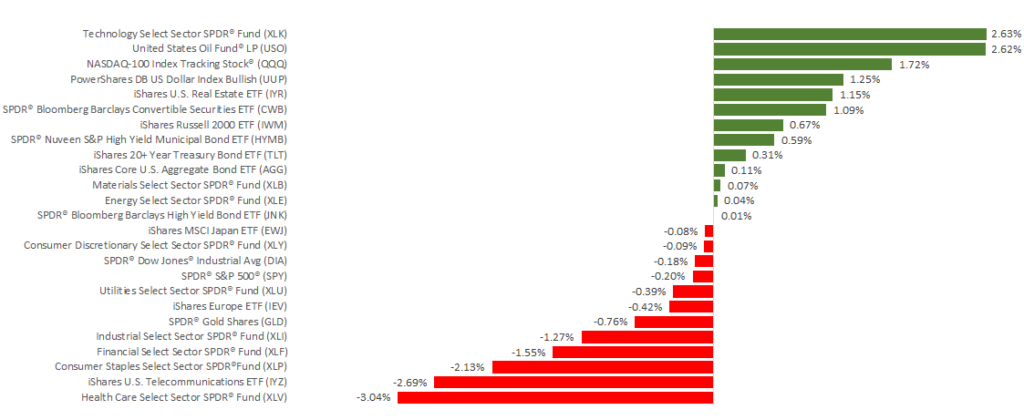

Domestic indexes posted strong results on Friday, May 4, as the latest labor report data lessened investors’ concerns about inflation and interest rates. Nonetheless, stocks had mixed results last week. The S&P 500 dropped 0.24% and the Dow gave back 0.20%, which marked both indexes’ 2nd week of losses in a row. Thanks to a bounce in tech stocks, however, the NASDAQ gained 1.26%. International stocks in the MSCI EAFE decreased by 0.57%.

Amid this relatively tepid performance, we reached a big milestone on May 1: Our current economic expansion is now officially the 2nd longest on record. For 8 years and 10 months, the economy has been growing, and many sectors still have room to advance.

As we look to better understand where we stand today, Friday’s employment report provides key insights into our economic health.

What We Learned About Employment –

- Growth Slowed

The report indicated that the economy added fewer jobs than expected in April, and average hourly wage growth also grew more slowly than forecast. Federal Reserve members watch this data closely to help anticipate changes in inflation. - Participation Dropped

The percentage of working-age people participating in the labor force dropped by 0.1%. This decline may result from people retiring or returning to school but can also come from people choosing to stop looking for work. The lower participation rate may contradict some of the more positive trends we’ve seen recently. - Unemployment Declined

Despite missing growth projections, unemployment fell to 3.9%, the lowest point in 18 years. The rate has only dropped below 4% during 3 other periods. The low unemployment numbers came more from the lower labor force participation rate than from more people finding jobs.

Key Takeaway

Lower participation rates could affect long-term economic growth. However, the combination of low unemployment and reasonable wage growth are likely a positive scenario for the economy. Many people who want jobs are already employed, but inflation should remain under control.

As the bull market lumbers toward its 9th year, many reports continue to indicate a solid economy. If the economic expansion continues through July 2019, it would be the longest in history (with records going back to the 1850s). While that accomplishment would be noteworthy, our focus remains on current circumstances, and striving to find insight that affects your financial future. From trade to jobs to manufacturing and beyond, we have many details to watch on your behalf.

ECONOMIC CALENDAR:

Tuesday: JOLTS

Thursday: Consumer Price Index, Jobless Claims

Friday: Consumer Sentiment