The Weekly Update

Week of October 21, 2018

By Christopher T. Much, CFP®, AIF®

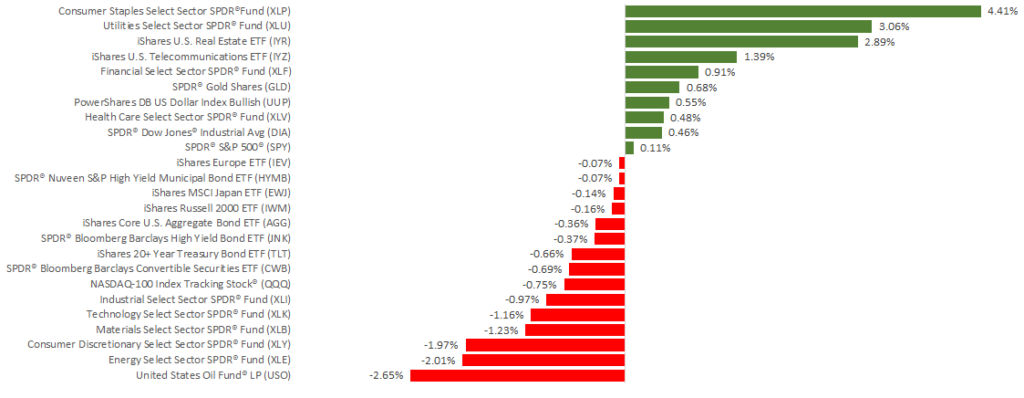

Stock performance was mixed last week as investors considered the impact of interest rates, international affairs and corporate earnings. The S&P 500 gained 0.02%, and the Dow added 0.41% to post its first weekly gains in October. The NASDAQ declined 0.64% and extended its losing streak. International stocks in the MSCI EAFE dropped by 0.08%.

While the final weekly results showed relatively little growth or loss, the week included some volatility. So far, domestic indexes have struggled this month. As of October 19, the S&P 500 and Dow had each lost more than 3% for the month, and the NASDAQ was down 7%.

As we have often discussed in our market updates, volatility may feel uncomfortable, but market fluctuations are normal. That perspective becomes especially relevant in October, which is considered the most volatile month for markets.

Examining October History

Historical performance can’t predict future results. However, we do believe that understanding what makes October unique can help provide context for the current environment.

- Significant market events

For generations, many of the most significant market events have taken place in October, including the crash of 1929 and multiple large drops in 2008. In addition, last Friday, October 19, marked the 31st anniversary of the “Bloody Monday” market crash. On that date in 1987, the S&P 500 lost over 20% of its value. - Higher than normal volatility

Since 1950, the S&P 500 has experienced more 1% moves in October than any other month. The month has also been the Dow’s most volatile since its beginning in 1896. - Surprising performance

Despite the large events and high volatility that October can bring, its results may be stronger than expected. For the past 20 years, October has had the strongest performance of any month.

Exactly how this month will end remains to be seen, as we still have a few trading days left. But we hope that understanding how much markets often move in October will help you ride out any future volatility with more confidence. Of course, we’re also here to provide any answers or information you need, so contact us any time.

ECONOMIC CALENDAR:

Wednesday: New Home Sales

Thursday: Durable Goods Orders, Jobless Claims

Friday: GDP, Consumer Sentiment