The Weekly Update

Week of April 23, 2018

By Christopher T. Much, CFP®, AIF®

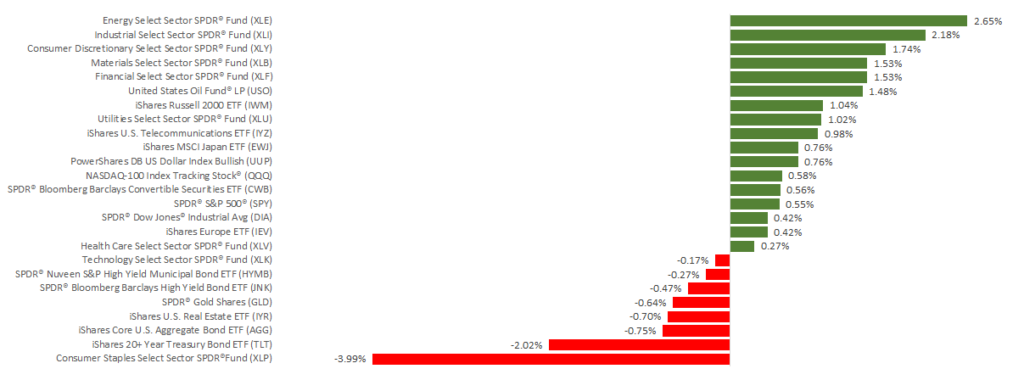

Stocks posted moderate gains last week, as the S&P 500 added 0.52%, the Dow increased 0.42%, and the NASDAQ rose 0.56%. International stocks in the MSCI EAFE followed suit, gaining 0.41%.

We received numerous new data updates last week, and most provided positive news for the economy. Retail sales, housing starts, and industrial production all beat expectations and increased in March.

Amid last week’s primarily positive data updates, two key occurrences also affected markets:

- Corporate earnings

- Treasury yields

A Closer Look

1. Earnings Season Continued

As of April 20, about 16% of S&P 500 companies shared their results for the 1st quarter, and over 80% of them beat earnings expectations. However, this solid performance has yet to impress investors. While most companies have exceeded earnings projections, their stocks haven’t reflected the growth.

On the other hand, companies that have beaten their sales projections—but missed on earnings-per-share—have dropped an average of 4.4% on their release days.

Takeaway: So far, corporate earnings are on the rise, but any companies that don’t beat estimates are experiencing considerable stock declines.

2. Treasury Yields Rose

The yield on 10-year Treasuries hit 2.96%—the highest point since 2014. At the same time, the 2-year yield climbed to its highest since 2008. When interest rates rise, companies have higher borrowing costs, and bonds become a more enticing alternative to stocks.

Some investors are also concerned that the difference between the two Treasuries’ yields is too close. This occurrence, known as a flattening yield curve, can imply that investors are not confident in the long-term economic outlook.

Takeaway: Rising Treasury rates are worth paying attention to. If they are a symptom of a growing economy, the markets should be able to handle them. However, if questions about economic growth accompany the increases, investors may worry.

What Is Ahead

We are now in earnings season’s busiest week, when more than a third of S&P companies will release their reports. Additionally, on Friday, April 27, the initial estimate of the 1st quarter Gross Domestic Product will come out.

All this information will help deepen our understanding of where the economy stands—and what may lie ahead. If you have any questions about current data or future projections, we are available to talk.

ECONOMIC CALENDAR:

Tuesday: New Home Sales, Consumer Confidence

Thursday: Durable Goods Orders, Jobless Claims

Friday: GDP, Employment Cost Index, Consumer Sentiment