The Weekly Update

Week of September 5, 2017

By Christopher T. Much, CFP®, AIF®

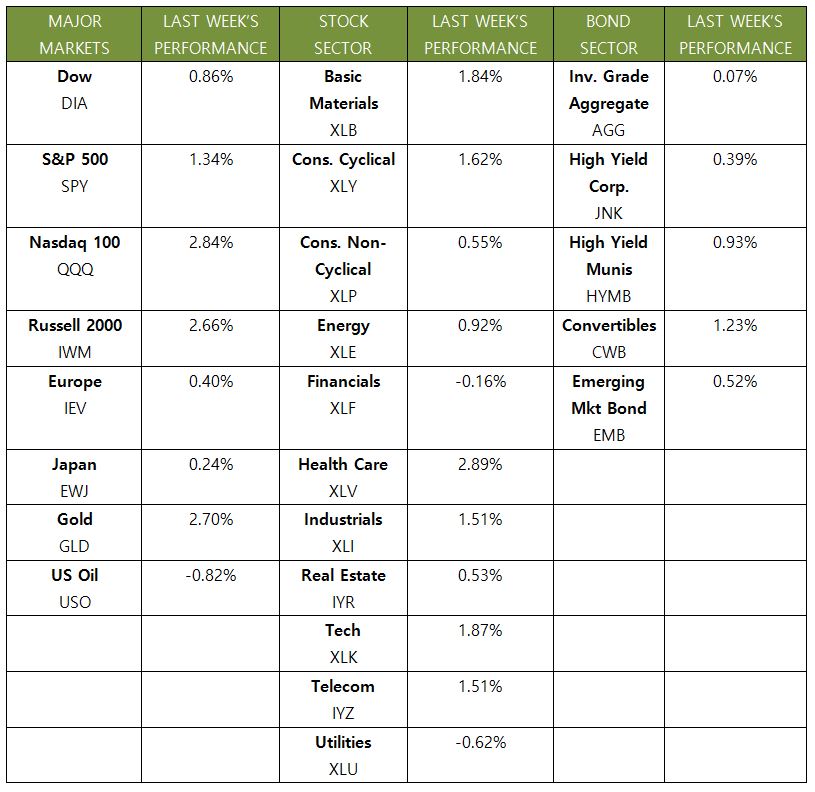

Last week gave a number of things for both investors and non-investors to think—and worry—about. From North Korea’s missiles to Hurricane Harvey’s devastation to an unemployment uptick, the headlines were busy. Yet, despite these circumstances, U.S. stocks posted gains again this week—and the NASDAQ ended Friday with a new record high and 2017’s best weekly performance. Overall, the S&P 500 added 1.37%, the Dow was up 0.80%, the NASDAQ gained 2.71%, and the MSCI EAFE increased by 0.55%.

So, what did we learn about the economy last week that helped contribute to these gains?

Big News: GDP Hits 2-Year High

On August 30, the Commerce Department released its second reading of Q2 Gross Domestic Product. After sluggish growth in the first quarter of 2017, consumer and business spending helped advance our economy in April through June. In fact, the revised reading increased to a 3% annual growth rate, which beat expectations and represented the fastest growth since Q1 of 2015.

As we predicted in last week’s market update, larger core durable goods orders contributed to this positive GDP report.

Solid Support: Manufacturing Index Jumps

The Institute for Supply Management’s manufacturing index, which measures business expansion or contraction, reached a 6-year high in August. According to Economist Andrew Hunter, this growth spike could generate GDP growth as high as 4% in the third quarter. That pace would be far above the average during the current economic recovery and would mean the economy is growing more quickly than many people expected.

Of course, we are still in Q3, and any number of details could affect economic growth. We have many important happenings on the horizon that the markets will be watching, including debt-ceiling decisions, tax-reform outcomes, and much more. However, recent data indicates that both consumers and businesses are opening their wallets—and the economy is growing. After 9 years of economic recovery where growth has often been lackluster, this quickening pace is welcome news.

Looking ahead, we will continue to focus on uncovering the best opportunities for your long-term goals. As more data and insight come in, we will keep you informed every step of the way.

ECONOMIC CALENDAR

Monday: U.S. Markets Closed for Labor Day

Tuesday: Factory Orders

Wednesday: ISM Non-Mfg Index

Thursday: Productivity and Costs, Bloomberg Consumer Comfort Index