The Weekly Update

Week of July 3rd, 2023

By Christopher T. Much, CFP®, AIF®

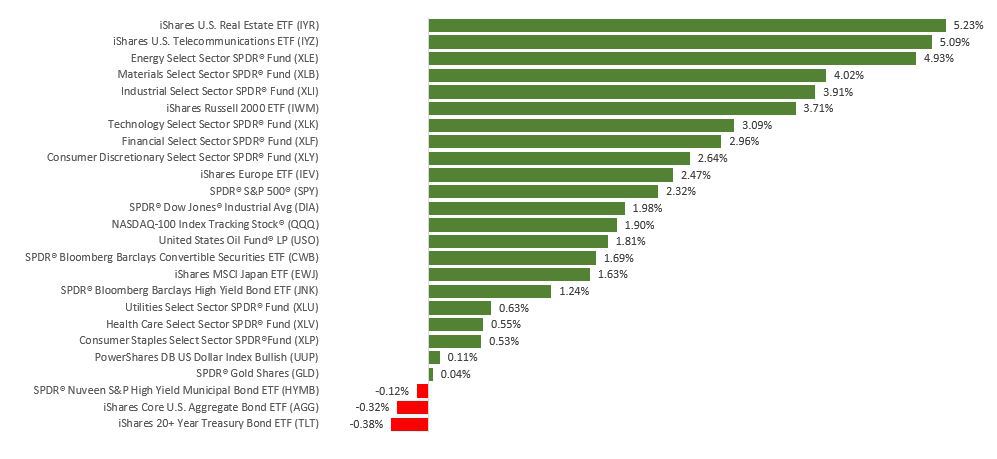

Stocks posted gains for the week to close out a stellar month, aided by positive economic data and reports that all major banks had passed the Federal Reserve’s annual stress test.

The Dow Jones Industrial Average gained 2.02%, while the Standard & Poor’s 500 rose 2.35%. The Nasdaq Composite index added 2.19%. The MSCI EAFE index, which tracks developed overseas stock markets, increased by 0.76%.

Stocks Climb as Recession Fears Ease

Investors shrugged off weekend news of a short-lived insurrection in Russia and calls later in the week for more restrictive monetary policies from global central bankers.

What powered early-week gains? New home sales, durable goods orders, and a rise in consumer confidence proved influential. More so were Thursday’s reports of a drop in initial jobless claims and an upward revision in first quarter Gross Domestic Product growth, which helped allay recession fears. The results of the Fed’s annual bank stress tests, which all major banks passed – further emboldened investors.

Stock prices rallied Friday following an encouraging inflation report, capping the end to a solid week, month, and first half.

Global Central Bankers Meet

At last week’s European Central Bank Forum, central-bank governors from around the world gathered to discuss their monetary outlook and the policies needed to manage inflation amid unexpected economic strength.

Fed Chair Powell reiterated that more rate hikes were coming owing to a robust labor market. He added that he wouldn’t dismiss the idea of hiking rates at consecutive Federal Open Market Committee (FOMC) meetings. While saying there is a possibility of an economic downturn, Powell didn’t believe it was the most likely case.

Meanwhile, bankers from the European Central Bank and the U.K. echoed Powell’s comments, declaring that further rate hikes are needed to tame their still-elevated inflation rates.

This Week: Key Economic Data

Monday: Purchasing Managers’ Index (PMI) Manufacturing. Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Factory Orders. FOMC Minutes.

Thursday: Automated Data Processing (ADP) Employment Report. Jobless Claims. Institute for Supply Management (ISM) Services Index. Purchasing Managers’ Index (PMI) Composite. Job Openings and Turnover Survey (JOLTS).

Friday: Employment Situation.

Source: Econoday, June 30, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Thursday: Seven and I Holdings Co., Inc. (SVNDY), Levi Strauss & Co. (LEVI)

Source: Zacks, June 30, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.