The Weekly Update

Week of April 18th, 2022

By Christopher T. Much, CFP®, AIF®

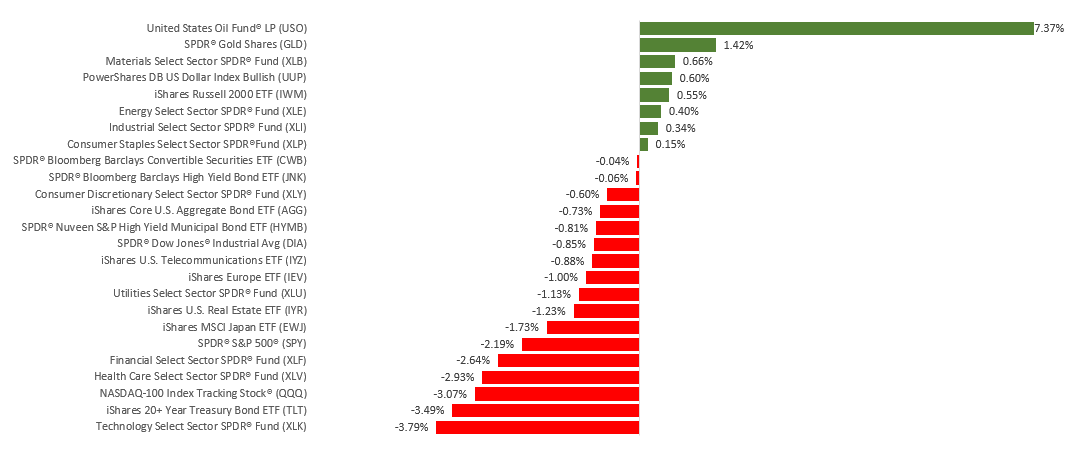

Stocks posted losses in a holiday-shortened trading week as the first-quarter earnings season kicked off and investors digested new inflation data.

The Dow Jones Industrial Average declined 0.78%, while the Standard & Poor’s 500 fell 2.13%. The Nasdaq Composite index dropped 2.63% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 1.20%.

Watching Bonds

Stocks began the week moving lower as bond yields climbed higher, with growth stocks suffering some of the steepest declines. Investors considered China’s ongoing lockdown warily, worried it might worsen supply-chain issues.

Historically high consumer and producer price inflation reports were shrugged off by the stock and bond markets in the main, with bond yields slipping despite the hot inflation numbers. Despite an encouraging start to the first-quarter earnings season, stocks pulled back on Friday as bond yields resumed their move higher ahead of a three-day holiday weekend.

An Eye on Inflation

On Tuesday, March’s Consumer Price Index (CPI) report offered little indication that inflation may be moderating, as prices increased 8.5% year-over-year, the fastest pace in 40 years. Core inflation, excluding food and energy prices, recorded a 6.5% jump, the steepest rise since August 1982. One encouraging note was that core inflation showed potential signs of ebbing, posting a monthly increase of 0.3% versus expectations of a 0.5% increase.

The following day, March’s Producer Price Index, a potential insight into future inflation, rose 11.2% year-over-year. A March survey by the National Federation of Independent Business released earlier in the week, indicated that half of the respondents were likely to raise prices in the next three months.

This Week: Key Economic Data

Tuesday: Housing Starts.

Wednesday: Existing Home Sales.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Friday: Purchasing Managers’ Index (PMI) Composite Flash.

Source: Econoday, April 15, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Bank of America Corporation (BAC), J.B. Hunt Transport Services, Inc. (JBHT).

Tuesday: Netflix, Inc. (NFLX), Johnson & Johnson (JNJ), International Business Machines Corporation (IBM), Lockheed Martin Corporation (LMT), Prologis, Inc. (PLD).

Wednesday: Tesla, Inc. (TSLA), The Procter & Gamble Company (PG), Lam Research Corporation (LRCX), CSX Corporation (CSX).

Thursday: AT&T, Inc. (T), United Airlines Holdings, Inc. (UAL), Snap, Inc. (SNAP), Blackstone, Inc. (BX), Union Pacific Corporation (UNP), Dow, Inc. (DOW).

Friday: Verizon Communications, Inc. (VZ), American Express Company (AXP), KimberlyClark Corporation (KMB).

Source: Zacks, April 15, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.