The Weekly Update

Week of August 10th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

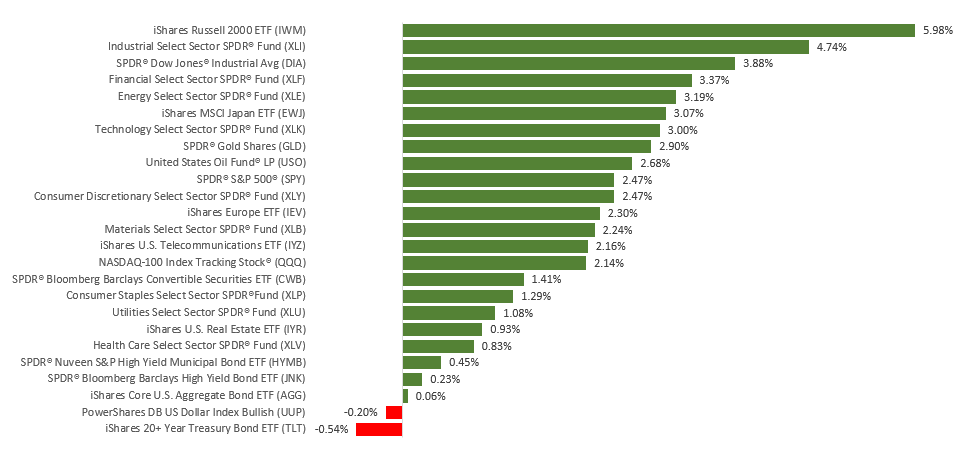

Overlooking stalled efforts by Congress to pass a new fiscal stimulus bill, stocks marched higher last week with the Dow Jones Industrials leading the way and the NASDAQ Composite setting multiple fresh record highs.

The Dow Jones Industrial Average gained 3.80%, while the Standard & Poor’s 500 rose by 2.45%. The Nasdaq Composite index climbed 2.47% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.31%.

Earnings Season Winds Down

A string of encouraging news reports, including a decline in new COVID-19 cases nationwide, pushed stock prices higher throughout the week. Stocks also rallied on signs of a pick-up in manufacturing activity, factory orders that came in well above estimates, and a better-than-expected new jobless claims number.

Congress wasn’t able to come to an agreement on a stimulus package, which disappointed some investors. But it wasn’t enough to slow the daily climb in the equity markets, with the NASDAQ Composite index closing above 11,000 for the first time, while the S&P 500 index closed in on its record high set in February of this year.

Stocks drifted on Friday even though the employment report showed that employers added 1.8 million jobs in July, lowering the unemployment rate to 10.2%.

One Eye on Bonds, Gold

The continued rally in stock prices appears to suggest that the U.S. economy may maintain its recovery through the second half of the year and into 2021. But the bond market and gold prices suggest a different outlook.

Last week the yield on 10-year Treasuries touched their lowest level since early March, signaling that bond investors may be less convinced about economic prospects.

Meanwhile, gold traded over $2,000 per ounce. While the rise in gold prices this year has been largely propelled by historically low interest rates, its reputation as a store of value has attracted investors worried about stock market volatility and a potential uptick in inflation.

Final Thoughts

It was reported last week that the U.S. and China agreed to meet by videoconference on August 15 to discuss compliance with the terms of the Phase One trade deal.

With tensions running high between the two nations, expect Wall Street to keep a close eye on any developments that may appear connected to the virtual meeting.

THIS WEEK: KEY ECONOMIC DATA

Monday: Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Consumer Price Index (CPI).

Thursday: Jobless Claims.

Friday: Retail Sales. Industrial Production. Consumer Sentiment.

Source: Econoday, August 7, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Marriott International (MAR)

Wednesday: Cisco Systems (CSCO), Tencent Holdings (TCEHY), Lyft (LYFT)

Friday: Draftkings (DKNG)

Source: Zacks, August 7, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.