The Weekly Update

Week of July 22, 2018

By Christopher T. Much, CFP®, AIF®

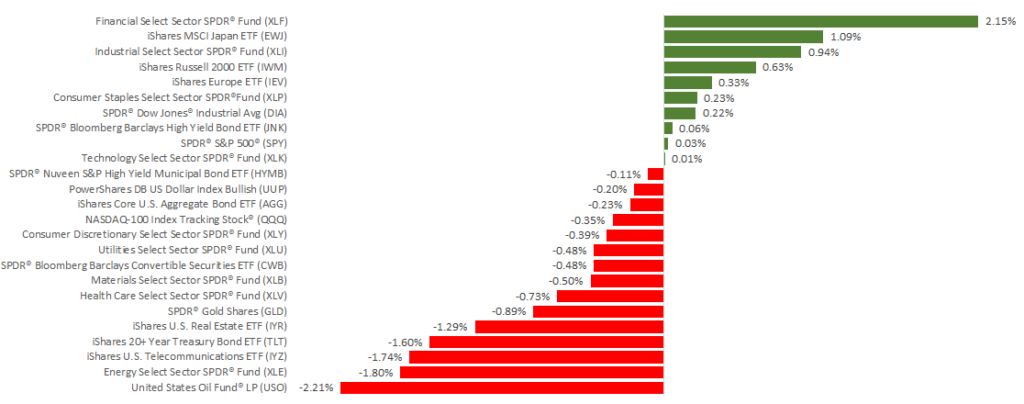

On Friday, July 20, stocks lost a small amount of ground after President Trump escalated his threats of increasing tariffs on China. However, strong quarterly earnings reports from several large companies helped provide balance in the markets. For the week, domestic indexes experienced little movement, as the S&P gained 0.02%, the Dow was up 0.15%, and the NASDAQ dropped 0.07%. International stocks in the MSCI EAFE had slightly more change, with a 0.63% gain.

What We Learned Last Week

- Corporate earnings rose in the 2nd quarter

As of July 20, 87 S&P 500 companies have released their 2nd quarter data. Of these companies, 83.9% surpassed analysts’ estimated results. In fact, the earnings season is going well enough that analysts have increased their growth projections. They now expect to see companies average 22% earnings growth over the past year, up from 20.7% growth projections on July 1. - Retail sales increased

The most recent retail sales data indicated that consumers feel confident in the economy and labor market. June’s strong growth, coupled with upward revisions to May’s results, support predictions for healthy Gross Domestic Product (GDP) increases in the 2nd quarter. - Industrial production hit a new record

In June, U.S. manufacturing and mining increased. Overall, industrial production had an annual rate that was 6.1% higher in the 2nd quarter than the 1st quarter of 2018. - Housing starts dropped

The latest housing-start report came in far below estimates. This decline occurred across all U.S. regions as homebuilders shared concerns about materials costs and labor shortages. However, housing start data often fluctuates from month-to-month, and reports show that the 1st half of 2018 is 7.4% higher than the same period last year.

What Is Ahead This Week

Corporate earnings season continues, and on Friday, we’ll receive the initial reading of 2nd quarter GDP. Last week’s retail sales and industrial production numbers contribute to very high expectations for economic growth results. Some estimates indicate that GDP could have increased as much as 5.2% in the 2nd quarter—much higher than the 2% growth between January and March.

We will watch these results closely and look for additional perspectives on the economy’s underlying strength. If you’d like to know more about what may lie ahead, contact us any time.

ECONOMIC CALENDAR:

Monday: Existing Home Sales

Wednesday: New Home Sales

Thursday: Durable Goods Orders, Jobless Claims

Friday: GDP, Consumer Sentiment