The Weekly Update

Week of April 16, 2018

By Christopher T. Much, CFP®, AIF®

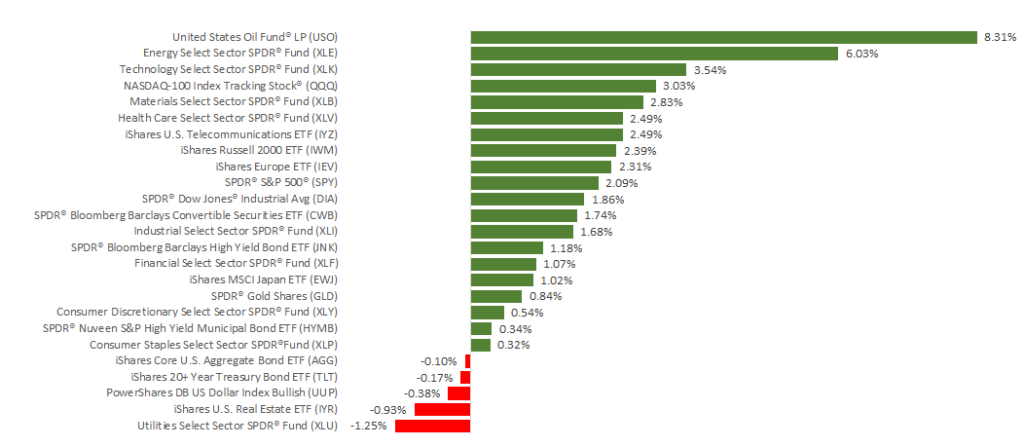

Market volatility continues. Stocks slid on Friday, April 13, but still held on to gains for the week. The S&P 500 increased 1.99%, the Dow added 1.79%, and the NASDAQ was up 2.77%. International stocks in the MSCI EAFE also rose, gaining 1.45%.

As in recent weeks, international events continued to sway markets: Concerns about trade disputes affected investor behavior. Meanwhile, escalating conflict in Syria may have weighed on people’s minds.

As we track these developments, we want to share insight about another important occurrence from last week: the beginning of corporate earnings season.

1st Quarter Corporate Earnings Season

1. Expectations remain very high

Analysts anticipate a particularly strong earnings season. Thomson Reuters data predicts that S&P 500 companies’ profits were 18.6% higher in the 1st quarter of 2018 than in 2017. If accurate, this increase would be the largest since 2011.

So far, data seems on track. According to The Earnings Scout, 1st-quarter earnings growth is currently at 26.8%.

2. Banks outperform but stocks drop

On Friday, 3 major banks released their reports—and each beat projections for earnings and revenue. Despite this positive news, however, their stocks experienced sizable declines that contributed to overall market losses.

Why would strong quarterly results create stocks losses?

The markets anticipated this positive performance and had already priced it into the shares. As a result, any less-than-ideal news seemed to outweigh the expected earnings and revenue increases. Two facts drove losses:

- 1 bank may have to pay a $1 billion penalty

- All 3 banks experienced slow loan growth

We are in the early stages of earnings season, and many major corporations still need to release their reports. In the coming weeks, we’ll continue monitoring these developments to better understand our economy. As always, please contact us if you have questions about how the data affects your finances and life.

ECONOMIC CALENDAR:

Monday: Retail Sales, Housing Market Index

Tuesday: Housing Starts, Industrial Production

Thursday: Jobless Claims