The Weekly Update

Week of January 30th, 2023

By Christopher T. Much, CFP®, AIF®

Stocks added to their early 2023 gains amid a busy stream of mixed corporate earnings results and conflicting economic data.

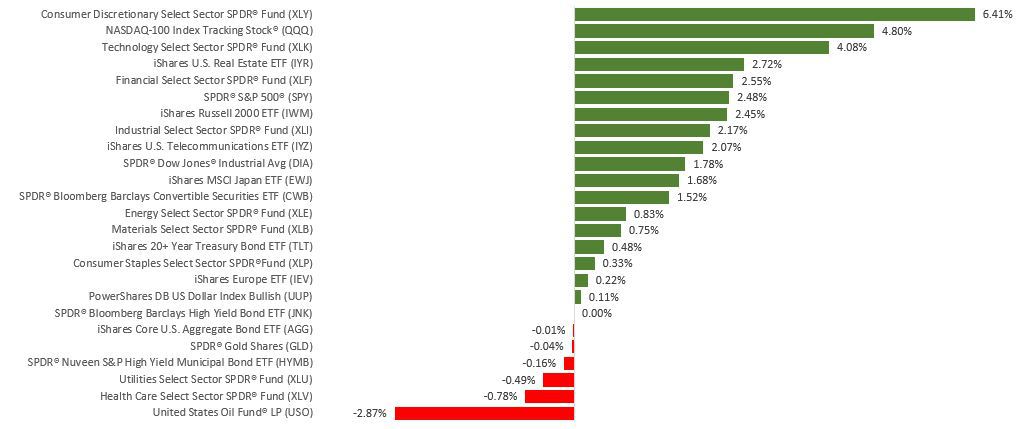

The Dow Jones Industrial Average gained 1.81%, while the Standard & Poor’s 500 added 2.47%. The Nasdaq Composite index rose 4.32% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, increased by 1.14%.

Stocks Advance

With the backdrop of earnings reports and conflicting economic data, stocks climbed higher on cooling inflation, continued economic resilience, and fourth-quarter corporate earnings results that, while underwhelming, did not appear as bad as many had feared.

There was enough new economic data to support both the “recession is coming” and the “soft landing” camps. It was corporate results and continued labor market strength, along with a solid, if weakening, fourth-quarter Gross Domestic Product (GDP) growth number, however, that raised investors’ hopes that a potential recession may be mild and likely pushed out to later in the year.

GDP Report

The U.S. economy expanded at a 2.9% annualized rate in the fourth quarter, slightly exceeding consensus estimates of 2.8% but down from the third quarter’s 3.2% growth rate. Consumer spending, which accounts for over two-thirds of GDP, rose 2.1%. Increases in private inventory investment, government spending, and nonresidential fixed investment also contributed to the fourth quarter’s growth. Weakness in housing and a drop in exports subtracted from the quarter’s result.

Beneath the headline number, the personal consumption expenditures price index (the Fed’s preferred measure of inflation) rose 3.2%. That was lower than the third quarter’s 4.8% increase, though it remains above the Fed’s 2% inflation target rate.

This Week: Key Economic Data

Wednesday: Federal Open Market Committee Announcement. Job Openings and Turnover Survey (JOLTS). Institute for Supply Management (ISM) Manufacturing Index. Automated Data Processing (ADP) Employment Report.

Thursday: Factory Orders. Jobless Claims.

Friday: Employment Situation. Institute for Supply Management (ISM) Services Index.

Source: Econoday, January 27, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Principal Financial Group, Inc. (PFG).

Tuesday: Advanced Micro Devices, Inc. (AMD), Pfizer, Inc. (PFE), Caterpillar, Inc. (CAT), General Motors Company (GM), McDonald’s Corporation (MCD), Amgen, Inc. (AMGN), United Parcel Service, Inc. (UPS), Stryker Corporation (SYK).

Wednesday: Thermo Fisher Scientific, Inc. (TMO), Humana, Inc. (HUM), TMobile US, Inc. (TMUS).

Thursday: Apple, Inc. (AAPL), Amazon.com, Inc. (AMZN), Ford Motor Company (F), Alphabet, Inc. (GOOGL), Qualcomm, Inc. (QCOM), Bristol Myers Squibb Company (BMY), Merck & Co., Inc. (MRK), Eli Lilly and Company (LLY), Honeywell International, Inc. (HON).

Friday: Cigna Corporation (CI), Regeneron Pharmaceuticals, Inc. (REGN).

Source: Zacks, January 27, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.