The Weekly Update

Week of February 18, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks ended a good week on a high note, as hints of progress in U.S.-China trade talks encouraged investors.

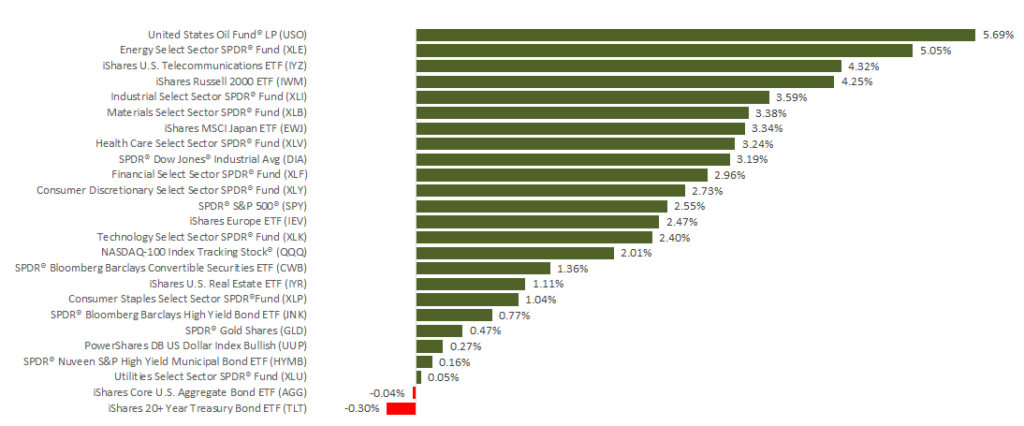

When the closing bell rang Friday, the S&P 500 settled at 2,775.60, after rising 2.50% in five days. The Dow Industrials gained 3.09%, to close Friday at 25,883.25. The Nasdaq Composite improved 2.39% to 7,472.41.

Shutdown Averted

Wall Street breathed a sigh of relief late last week as Congress passed a bill to keep the federal government funded. President Trump signed the measure on Friday.

The development is expected to have a positive effect on consumer sentiment, which may influence the financial markets. During the shutdown, consumer confidence hit an 18-month low.

Retail Sales Unexpectedly Slip

Thursday, the Census Bureau announced that retail sales fell 1.2% in December. This was the largest monthly decline in more than nine years and fell short of expectations. Economists polled by Bloomberg anticipated a small gain.

Was the slow December mostly a reflection of consumer anxieties about the shutdown and the stock market? If so, it is possible that retail spending may see an uptick. (It should be noted that these monthly numbers are often revised later.)

Inflation Holds Steady

The Consumer Price Index (CPI), the most widely followed measure of inflation, was flat in January for a third consecutive month. Year-over-year, overall inflation is running at just 1.6%.

The CPI is one of the key factors the Fed considers when assessing the economy and determining what lies ahead for interest rates.

What’s Ahead

U.S. and Chinese negotiators face a March 1 deadline to reach a deal to extend the current tariff truce. In March, tariffs on many Chinese imports could rise to 25% from 10%. President Trump said Friday that he is open to postponing the March deadline if it appears an agreement may be near.

ECONOMIC CALENDAR:

Monday: Presidents’ Day holiday (U.S. financial markets closed).

Wednesday: Minutes of the January Federal Reserve policy meeting are released.

Thursday: January existing home sales.

Friday: Federal Reserve Vice Chairman Richard Clarida speaks in New York.

Source: Econoday / MarketWatch Calendar, February 15, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons, including the shutdown of the government agency or change at the private institution that handles the material.