The Weekly Update

Week of November 11th, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Domestic and international stocks rose last week. Risk appetite outweighed concerns about the state of U.S.-China trade discussions.

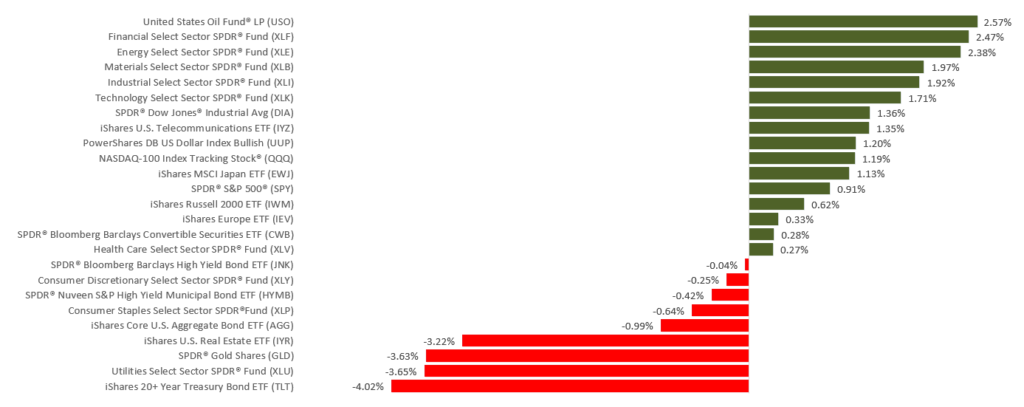

The Dow Jones Industrial Average, Nasdaq Composite, S&P 500, and MSCI EAFE all ended the week with gains. Blue chips led the way, as the Dow added 1.22%. The Nasdaq improved 1.06%; the S&P, 0.85%. The EAFE, tracking developed stock markets away from North America, was up 0.76%. The Dow recorded its third straight weekly gain; the S&P, its fifth.

Will Tariffs Phase Out or Remain?

Thursday, a spokesman for China’s commerce ministry said that U.S. and Chinese trade representatives had “agreed to remove” existing tariffs in “phases,” while working toward a new trade deal.

On Friday morning, President Trump told the media that he had not agreed to any such condition. President Trump and Chinese President Xi Jinping are still expected to sign off on “phase one” of a new bilateral trade agreement

Service Sector Activity Picks Up

A closely watched index of U.S. business activity posted an October gain. The Institute for Supply Management’s Purchasing Managers Index for non-manufacturing firms rose nearly two points last month to 54.7. ISM also noted an October increase for new orders.

As most U.S. companies provide services rather than manufacture products, this news is encouraging and suggests more momentum in that sector.

Final Thought

Monday is Veterans Day; the stock market will be open, but the bond market, plus all federal government offices, will be closed.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: Federal Reserve Chairman Jerome Powell begins two days of testimony on the country’s economic outlook in Congress, and the Bureau of Labor Statistics presents new inflation data in the October Consumer Price Index.

Friday: October retail sales figures arrive from the Census Bureau.

Source: Econoday, November 8, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Praxair (LIN), Tyson Foods (TSN)

Wednesday: Cisco (CSCO)

Thursday: Applied Materials (AMAT), Nvidia (NVDA), Walmart (WMT)

Source: Zacks, November 8, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.