The Weekly Update

Week of September 9, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks rose last week, with help from two developments: the announcement of further U.S.-China trade talks as well as August hiring and manufacturing numbers that seemed to bolster the argument for a rate cut by the Federal Reserve.

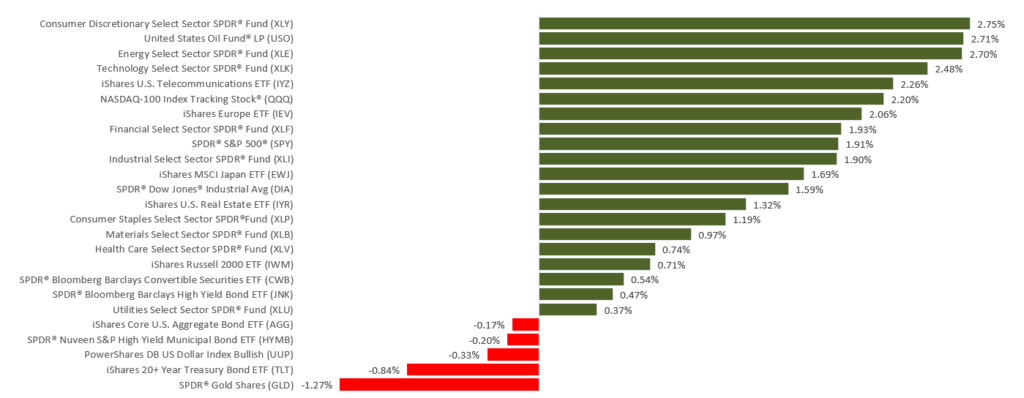

The broad U.S. equity market, as represented by the S&P 500, added 1.79% during a 4-day trading week. The Dow Jones Industrial Average improved 1.49%; the Nasdaq Composite, 1.76%. Foreign shares tracked by the MSCI EAFE index gained 1.69%.

Trade Talks Poised to Restart

Trade representatives from the U.S. and China are planning to head back to the negotiating table early next month. This news came Thursday from China’s ministry of commerce, which confirmed a verbal agreement among Secretary of the Treasury Steven Mnuchin, U.S. Trade Representative Robert Lighthizer, and Chinese Vice Premier Liu He.

Formal trade discussions between the U.S. and China last happened in July. China has said that it wants punitive U.S. tariffs on its products removed in the event of a deal.

Weaker Hiring & Manufacturing Data

Payrolls expanded with just 130,000 net new jobs in August, according to the Department of Labor; 25,000 were temp jobs linked to the federal government’s 2020 Census. The main jobless rate stayed at 3.7%. The U-6 rate, which measures both unemployment and underemployment, rose 0.2% to 7.2%.

A key gauge of U.S. factory activity, the Institute for Supply Management’s manufacturing purchasing manager index, fell to 49.1 in August. A number below 50 indicates factory sector contraction. Some investors took these hiring and manufacturing reports as hints of a slowing economy, one which the Federal Reserve could potentially try to stimulate with an interest rate cut.

What’s Ahead

August inflation data arrives this week, and if looks especially mild, it may amount to another suggestion that the Fed should ease. The European Central Bank concludes a meeting on Thursday, and Fed officials will certainly pay attention to its latest policy statement.

THE WEEK AHEAD: KEY ECONOMIC DATA

Thursday: A new Consumer Price Index, tracking both monthly and yearly inflation.

Friday: The August retail sales report from the Census Bureau.

Source: Econoday / MarketWatch Calendar, September 6, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Thursday: Broadcom (AVGO), Kroger (KR)

Source: Zacks, September 6, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.