The Weekly Update

Week of November 30th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks surged last week, ignited by another COVID-19 vaccine announcement, encouraging economic data, and the easing of political uncertainty.

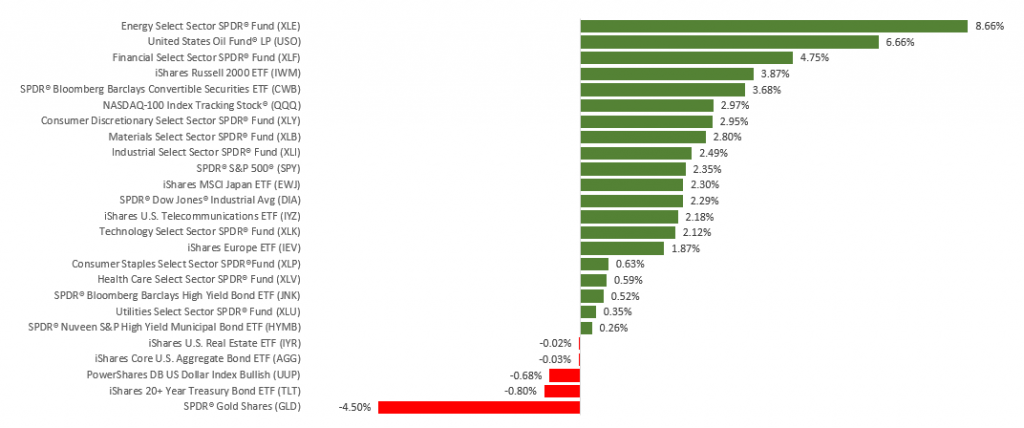

The Dow Jones Industrial Average rose 2.21%, while the Standard & Poor’s 500 added 2.27%. The Nasdaq Composite index, which has led all year, gained 2.96%. The MSCI EAFE index, which tracks developed overseas stock markets, climbed 1.54%.

Dow Breaks 30,000

For the third consecutive week, markets opened on Monday to yet another announcement of a potential COVID-19 vaccine.

Stock prices found additional support on news that President-elect Biden would be nominating Janet Yellen, the former Chair of the Federal Reserve, to be Secretary of the Treasury. Investors reacted well to the choice, encouraged by her previously voiced support for greater fiscal stimulus and relieved that a candidate less antagonistic to the industry was selected.

Positive momentum continued into the following day, driving the Dow Jones Industrial Average, S&P 500 index, and the Russell 2000 to record high levels, with the Dow closing above the 30,000 milestone.

Stocks eased off their highs in pre-Thanksgiving trading, though they recovered some of those losses on Friday, as the S&P 500 and NASDAQ Composite closed with fresh record highs.

A Microcosm of the Economy

The economic outlook has been difficult to figure out due to conflicting signals. One day it’s a historic jump in economic growth; another day it’s a record high in new COVID-19 infections. Last week was a good illustration of this. Reports of healthy consumer spending, a solid rise in durable goods orders, and sales of new homes remaining near almost-14-year highs were balanced by a jump in new jobless claims, a decline in household income, and new state and local COVID-related restrictions.

Last week investors chose to see the glass half full and look past the near-term challenges the economy faces.

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims, Institute for Supply Management (ISM) Services Index.

Friday: Employment Situation, Factory Orders.

Source: Econoday, November 27, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Zoom Video Communications (ZM)

Tuesday: Salesforce.com (CRM)

Wednesday: Splunk (SPLK), Snowflake, Inc. (SNOW), Crowdstrike Holdings (CRWD)

Thursday: Marvell Technologies (MRVL), Dollar General (DG), Docusign (DOCU)

Source: Zacks, November 27, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.