The Weekly Update

Week of April 4th, 2022

By Christopher T. Much, CFP®, AIF®

Stocks spent last week digesting the sharp gains of previous weeks as investors assessed a tightening yield curve, the war in Ukraine, and an uncertain outlook for economic growth and inflation.

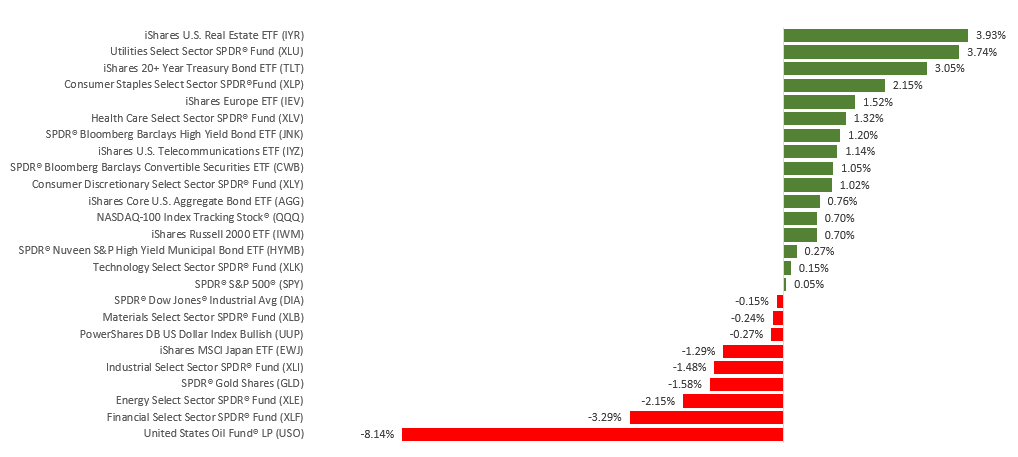

The Dow Jones Industrial Average slipped 0.12%, while the Standard & Poor’s 500 was flat (+0.06%). The Nasdaq Composite index led, picking up 0.65% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, rose 1.02%.

Stocks Pause

Stock prices bounced around following strong gains in two previous weeks as money managers appeared to reposition their portfolios ahead of the first-quarter close. Oil was under pressure all week as prices fell on news that Shanghai imposed a strict lockdown due to COVID infections. President Biden announced a sustained release of oil from the country’s strategic petroleum reserve.

Bond yields reversed their recent climb. The flattening in the yield curve triggered some concerns about economic growth and the possibility of a recession.

Labor Market

With economic growth worries overhanging the market, last week’s employment reports showed continued strong demand for workers. The Job Openings and Labor Turnover Survey reported the number of open positions remained near record highs, with job openings exceeding the number of available workers by a record five million. Afterward, the Automated Data Processing employment report saw private payrolls grow by 455,000 in March, slightly above consensus expectations.

Finally, the government’s monthly jobs report showed that employers added 431,000 jobs in March, lowering the unemployment rate to 3.6%. That’s approaching the 50-year low of 3.5% reached in February 2020.

This Week: Key Economic Data

Monday: Factory Orders.

Tuesday: Institute for Supply Management (ISM) Services Index.

Wednesday: Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims.

Source: Econoday, April 1, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Levi Strauss & Co. (LEVI).

Thursday: Conagra Brands (CAG).

Source: Zacks, April 1, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.