The Weekly Update

Week of May 22nd, 2023

By Christopher T. Much, CFP®, AIF®

Stocks rallied last week, propelled by growing optimism overreaching a deal on raising the debt ceiling and avoiding a technical debt default by the U.S.

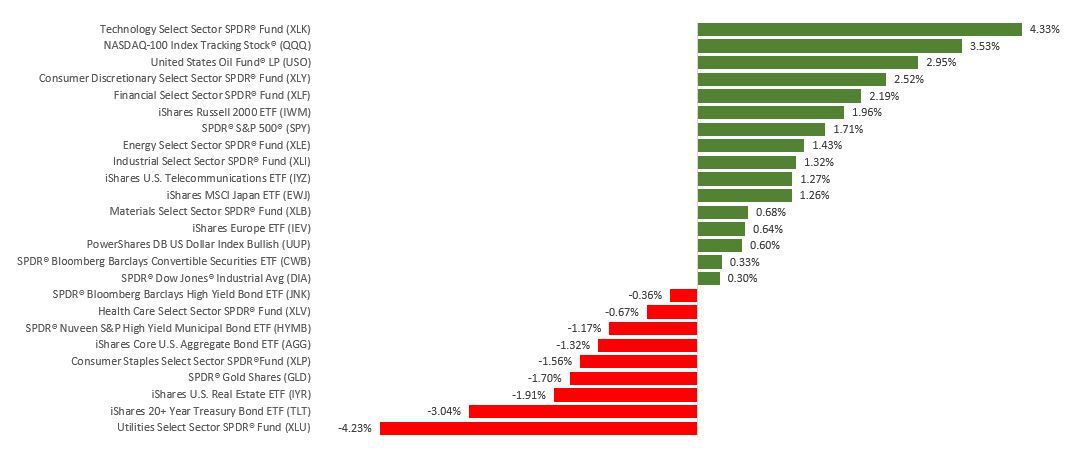

The Dow Jones Industrial Average edged 0.38% higher, while the Standard & Poor’s 500 gained 1.65%. The Nasdaq Composite index advanced 3.04% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 0.47%.

Possible Debt Deal

After stumbling on weak April retail sales and a combination of disappointing earnings and weak guidance from a major retailer, stocks moved higher mid-week as the news on the debt negotiations turned more positive.

The prospect of an agreement helped to lift a cloud of uncertainty that had weighed on markets in recent weeks and sparked sufficient optimism to shake off comments by the Dallas Fed President, who indicated that economic data may not support a pause in rate hikes yet. Aiding the market’s upbeat mood was a positive update on deposit growth at a troubled regional bank.

Stocks surrendered some of the week’s gains on Friday following reports of an impasse on debt talks and comments by Fed Chair Powell.

Housing Mixed

Recent updates have suggested that the housing market may be staging a turnaround after a long period of contraction. Last week’s data contained some fresh evidence of revival and caution that any potential recovery may remain further out.

The first positive sign was an increase in home builder sentiment that put the National Association of Home Builders Housing Market Index’s confidence level at the midpoint for the first time since July 2022. An unexpected 2.2% rise in housing starts in April followed. These encouraging reports, however, were followed by a disappointing 3.4% decline in April existing home sales

This Week: Key Economic Data

Tuesday: Purchasing Managers’ Index (PMI) Composite. New Home Sales.

Wednesday: FOMC Minutes.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment. Personal Income and Outlays. Durable Goods Orders.

Source: Econoday, May 19, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Zoom Video Communications, Inc. (ZM)

Tuesday: Lowe’s Companies, Inc. (LOW), Palo Alto Networks, Inc. (PANW), AutoZone, Inc. (AZO), Intuit, Inc. (INTU)

Wednesday: Nvidia Corporation (NVDA), Analog Devices, Inc. (ADI), Snowflake, Inc. (SNOW)

Thursday: Costco Corporation (COST), Marvell Technology, Inc. (MRVL), Workday, Inc. (WDAY)

Source: Zacks, May 19, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.