The Weekly Update

Week of May 29th, 2023

By Christopher T. Much, CFP®, AIF®

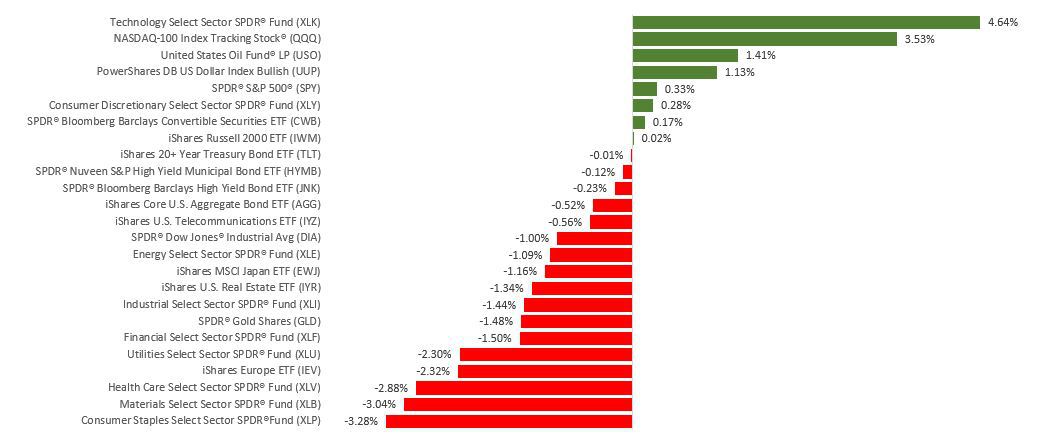

Markets moved in sync last week with perceived movement in debt ceiling talks, weakening early in the week, and then surging on news of progress. A solid quarterly report and guidance from a mega-cap technology company helped with enthusiasm.

Overall, the markets were mixed, with the Dow Jones Industrial Average down 1.00%, while the Standard & Poor’s 500 gained 0.32%. The Nasdaq Composite index led, picking up 2.51% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, sank 2.92%.

Debt Talks Dominate

Stocks were weighed down for much of the week by stumbling debt ceiling negotiations, which appeared to reach an impasse at one point. Technology stocks, which have led the market this year, were under pressure as traders began to anticipate the possibility of rate hikes in June and July.

Sentiment turned more optimistic after the release of an above-consensus earnings report and strong guidance from a mega-cap chip giant. The momentum continued into Friday as stocks surged on hopes of a debt ceiling agreement, undeterred by an inflation read that may induce the Fed to raise interest rates further.

A Fed Divided

The minutes of the Federal Open Market Committee (FOMC) May meeting reflected division among committee members over whether further rate increases were necessary, with more than half suggesting that they were ready to pause. Those members supporting additional rate hikes said inflation was moving too slowly toward the Fed’s two percent target inflation rate.

The minutes also reaffirmed the Fed’s expectation of a recession beginning around the fourth quarter. In comments last Wednesday, Fed governor Christopher Waller manifested this division, saying that it was a toss-up as to whether rates should be raised, suggesting that he could support a rate hike in June or wait on voting for an increase until July’s meeting.

This Week: Key Economic Data

Tuesday: Consumer Confidence.

Wednesday: Job Openings and Labor Turnover (JOLTS).

Thursday: Automated Data Processing (ADP) Employment Report. Jobless Claims. Institute of Supply Management (ISM) Manufacturing Index.

Friday: Employment Situation.

Source: Econoday, May 26, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: HP, Inc. (HPQ)

Wednesday: Salesforce, Inc. (CRM), CrowdStrike (CRWD)

Thursday: lululemon athletica, inc. (LULU), Broadcom, Inc. (AVGO), Dollar General Corporation (DG), Dell Technologies, Inc. (DELL)

Source: Zacks, May 26, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.