The Weekly Update

Week of March 7th, 2022

By Christopher T. Much, CFP®, AIF®

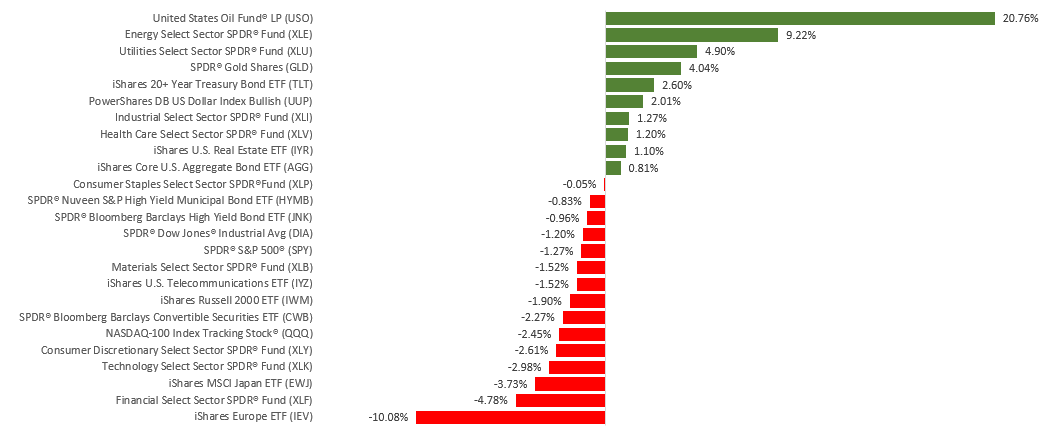

War in Ukraine weighed on stocks as investors assessed the economic impact of continued hostilities, expanding economic sanctions, and potentially higher inflation due to rising oil prices and new stresses on the global supply chain.

The Dow Jones Industrial Average fell 1.30%, while the Standard & Poor’s 500 lost 1.27%. The Nasdaq Composite index slid 2.78% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 3.21%.

Another Volatile Week

The uncertainty introduced from Russia’s invasion continued to whipsaw the financial markets last week. Intensifying hostilities early in the week sent stocks sharply lower as oil prices surged and a flight to safety drove investors to buy bonds.

Stocks rebounded mid-week following the release of positive economic data and Congressional testimony by Fed Chair Jerome Powell, who said the Fed is likely to move forward on rate hikes but would proceed cautiously. Investor enthusiasm was short-lived, however, as stocks resumed their decline on Thursday into Friday despite a strong employment report.

Powell Testifies

Fed Chair Powell told Congress on Wednesday that he would propose a 25-basis point increase in the federal funds rate when the Federal Open Market Committee meets in mid-March. He conceded that the invasion of Ukraine and the economic sanctions against Russia introduced a level of uncertainty, and that the Fed would proceed carefully with monetary tightening.

Powell also testified that he would not have the Fed’s strategy to shrink its balance sheet finalized before the mid-March meeting. Alluding to the urgency of fighting inflation, Powell left the door open to more aggressive rate hikes later in the year.

This Week: Key Economic Data

Wednesday: JOLTS (Job Openings and Labor Turnover Survey).

Thursday: Consumer Price Index. Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, March 4, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Guidewire Software, Inc. (GWRE).

Wednesday: Asana, Inc. (ASAN).

Thursday: JD.com, Inc. (JD), Ulta Beauty, Inc. (ULTA), DocuSign (DOCU), Rivian Automotive, Inc. (RIVN).

Source: Zacks, March 4, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.