The Weekly Update

Week of June 23rd, 2025

By Christopher T. Much, CFP®, AIF®

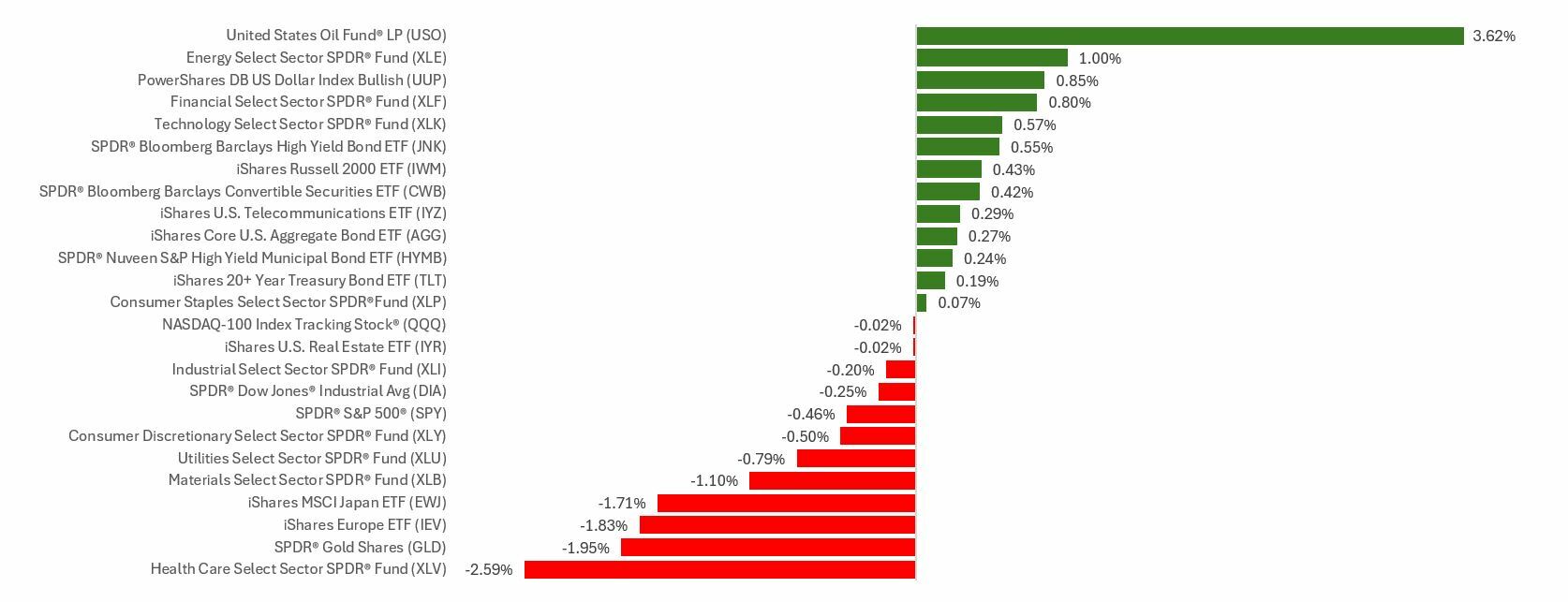

Stocks were mixed during the holiday-shortened trading week as uncertainty over conflict in the Middle East weighed on investors.

The Standard & Poor’s 500 Index slipped by 0.15 percent, while the Nasdaq Composite Index rose by 0.21 percent. The Dow Jones Industrial Average was flat (+0.02 percent). The MSCI EAFE Index, which tracks developed overseas stock markets, declined 1.54 percent.

Stocks Rise, Then Slump

Stocks opened higher, and oil prices fell at the start of the week as investors hoped Middle Eastern tensions would ease.

However, as investors parsed through updates on the conflict, stocks fell over ongoing uncertainty. Conflicting statements from those involved, as well as from world leaders, contributed to the uncertainty.

Midweek, stocks rallied ahead of the Fed’s interest rate decision. Markets seemed to dismiss news that housing starts dropped unexpectedly to their lowest level in five years.

The Fed held short-term rates steady. Stocks moved up and down during the Fed Chair’s press conference before ending the trading session slightly down ahead of Thursday’s stock market holiday.

Following the holiday, anxious investors refocused on geopolitical tensions and developments. As the week closed out, investors appeared to take a risk-off approach heading into the weekend.

The Fed Holds Rates Steady

As expected, the Federal Reserve kept the Fed funds rate at its target range of 4.25 percent and 4.5 percent. However, the central bank did suggest it may adjust rates later this year, and policymakers expressed concerns about inflation and the outlook for gross domestic product.

Following the decision, Fed Chair Powell said policymakers are “well positioned to wait” before moving on short-term rates. Powell indicated that trade policy has clouded the inflation outlook, making policymakers concerned about consumer prices.

This Week: Key Economic Data

Monday: Manufacturing and Services PMI. Existing Home Sales.

Tuesday: S&P Case-Shiller Home Price Index. Cleveland Fed President Beth Hammack speaks. Consumer Confidence. Fed Chair Powell Testifies to House Financial Services Committee.

Wednesday: New Home Sales.

Thursday: Gross Domestic Product (GDP). Retail & Wholesale Inventories. Trade Balance. Durable Goods. Cleveland Fed President Beth Hammack speaks. Pending Home Sales.

Friday: Personal Consumption & Expenditures (PCE) Index. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; June 20, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: FedEx Corporation (FDX)

Wednesday: Micron Technology, Inc. (MU), Paychex, Inc. (PAYX)

Thursday: NIKE, Inc. (NKE)

Source: Zacks, June 20, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.