The Weekly Update

Week of October 2nd, 2023

By Christopher T. Much, CFP®, AIF®

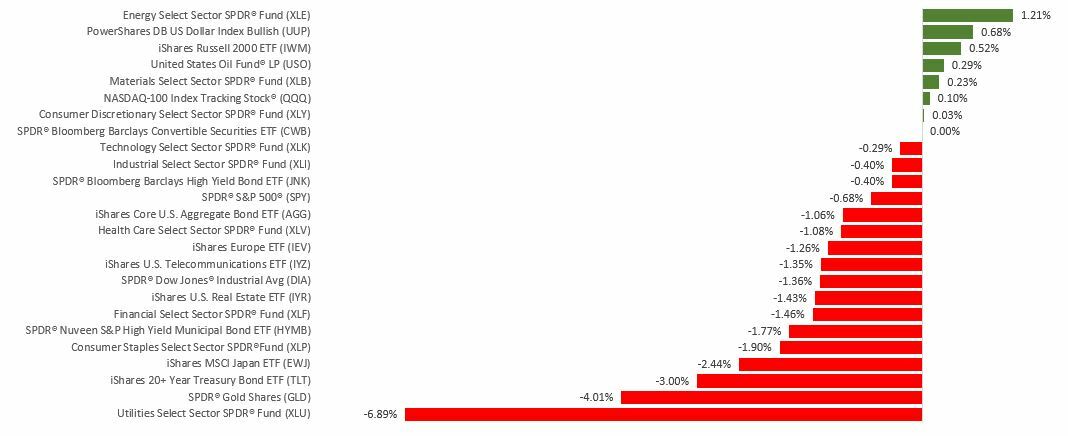

Rising bond yields and government shutdown fears left stocks in mostly negative territory for the week.

The Dow Jones Industrial Average lost 1.34%, while the Standard & Poor’s 500 slipped 0.74%. The Nasdaq Composite index was flat (+0.06%) for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 1.95%.

Stocks Follow the Bond Market

The bond market drove stock prices for much of last week as investors fretted about rising bond yields. After beginning the week with small gains, stocks resumed their September decline amid weak housing data and a decline in consumer confidence. However, it was the jump in bond yields, which sent the 10-year Treasury yield to near a 15-year high, that may have most undermined investor sentiment.

After a failed attempt at a rebound mid-week, stocks staged a Thursday rally on a pause in bond yield increases–a rally that extended into Friday morning on an encouraging core personal consumption expenditures (PCE) price index report. (PCE is the Fed’s preferred inflation gauge.) But the rally faded as traders fixated on a potential government shutdown.

Mixed Economic Signals

Amid recent signs of a labor market cooling (a hopeful sign for ending rate hikes), last Thursday’s initial jobless claims report showed only a slight increase of 204,000. That was the second-lowest reading since January and below economists’ expectations of 215,000. Continuing claims declined by 12,000.

That same morning, the final estimate of second-quarter GDP was released, indicating a 2.1 annualized growth rate–unchanged from the previous estimate. However, beneath the headline number, consumer spending was cut to a 0.8 percent rise from its earlier estimate of 1.7 percent–a worrisome revision since consumer spending is the engine of the U.S. economy.

This Week: Key Economic Data

Monday: Institute for Supply Management (ISM) Manufacturing Index.

Tuesday: Job Openings and Turnover Survey (JOLTS).

Wednesday: Automated Data Processing (ADP) Employment Report. Institute for Supply Management (ISM) Services Index.

Thursday: Jobless Claims.

Friday: Employment Situation.

Source: Econoday, September 29, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Thursday: Constellation Brands, Inc. (STZ)

Source: Zacks, September 29, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.