The Weekly Update

Week of November 27, 2017

By Christopher Much, CFP®, AIF®

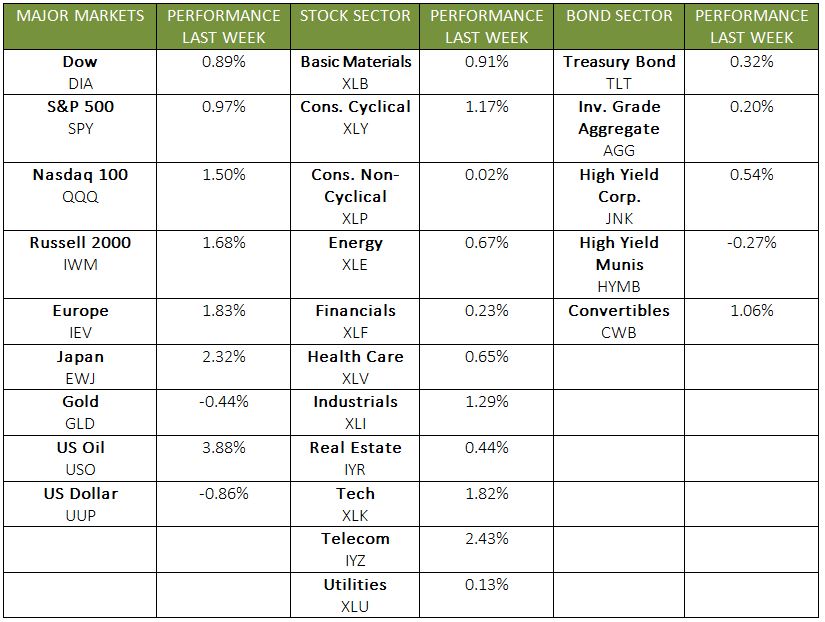

Last week was a relatively quiet time in the domestic markets. We did not receive a tremendous amount of economic data, and trading halted Thursday for the Thanksgiving holiday. Nonetheless, all 3 of the major domestic indexes experienced sizable gains in only 4 trading days. By Friday, the S&P 500 added 0.91% and closed above 2,600 for the first time in its history. The Dow was also up 0.86%, and the NASDAQ gained 1.57%. International stocks in the MSCI EAFE had a 5-day trading week and grew by 1.85%.

A variety of factors contributed to this performance—from growth in the tech sector to increasing crude oil prices. But a specific event also helped push stocks higher: Black Friday.

The Black Friday Effect

What happened on Black Friday this year?

In the U.S., Black Friday is big business. The day after Thanksgiving is typically the year’s biggest shopping day and jump-starts the holiday season with enticing deals. The financial markets even close early because trading activity is traditionally so slow.

This year, a combination of low unemployment and healthy consumer confidence may help the retail industry. Many retailers saw lines forming outside their locations on Thanksgiving, while digital shopping also picked up. Shoppers spent $1.52 billion online by 5 p.m. ET on Thursday. And the next morning they made $640 million in online purchases by 10 a.m.—18.4% higher than at that time last year.

Why does holiday shopping matter?

Black Friday may not have the same urgency it once did, as fewer people fight for deals in person. Even without huge crowds at brick-and-mortar shops, many retailers declared the day a success—and posted stock gains on Friday.

Overall, industry experts predict holiday sales may grow by as much as 4.5% compared to last year. This growth matters because strong consumer spending is good for the economy. In fact, consumer spending accounts for more than two-thirds of gross domestic product. If spending is flat, so is economic growth. Thus, solid purchasing can help drive our economy to pick up speed.

We were pleased to see the markets experience a positive Black Friday effect, and we’ll continue to review this year’s spending data and stock performance. In the meantime, if you have any questions about where our economy stands or what lies ahead, please contact us.

ECONOMIC CALENDAR

Monday: New Home Sales

Tuesday: Consumer Confidence

Wednesday: GDP, Pending Home Sales Index

Thursday: Jobless Claims

Friday: Motor Vehicle Sales, PMI Manufacturing Index, ISM Mfg Index, Construction Spending