The Weekly Update

Week of July 17th, 2023

By Christopher T. Much, CFP®, AIF®

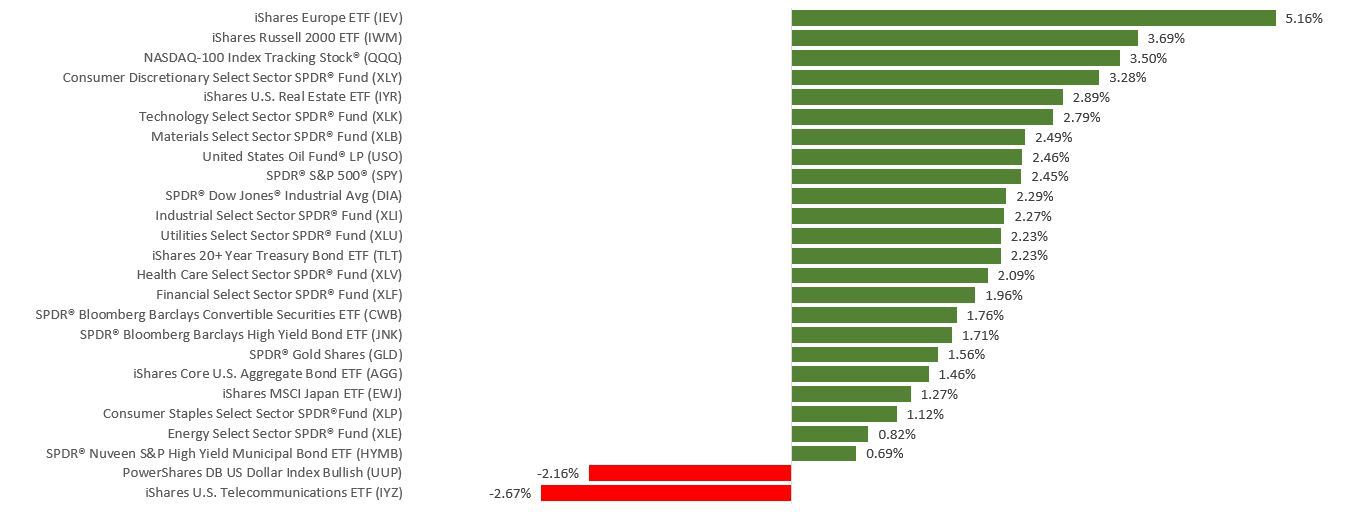

Better-than-expected updates last week on consumer and wholesale price inflation buoyed investor sentiment, driving stocks higher and lower bond yields.

The Dow Jones Industrial Average rose 2.29%, while the Standard & Poor’s 500 increased 2.42%. The Nasdaq Composite index advanced 3.32% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 4.67%.

Inflation Sparks Stocks

Back-to-back positive inflation reports emboldened investors, sending stocks to their highest levels since April 2022. Lower-than-forecast inflation on both consumer prices and producer prices sparked investor optimism that inflation may be able to fall further without tipping the economy into recession and provide the basis for the Fed to moderate its more hawkish rate hike stance.4

After four straight days of increases, investor attention turned to the kick-off of a new earnings season on Friday. Despite some positive earnings surprises from several big banks and a major healthcare provider, stocks closed out a good week with a slight decline.

Inflation Cools

Inflation continued its downward trend last month, falling at its slowest pace in over two years. Consumer prices rose 0.2% in June and 3.0% from a year ago. Both were below economists’ consensus forecast. Core inflation (excludes food and energy), which has been more stubborn, fell to 4.8% year-over-year–its lowest level since October 2021.

The positive disinflationary story continued the following day with a lighter-than-forecast increase in producer prices. Wholesale prices increased 0.1% in June, which was lower than the consensus forecast of 0.2%. The increase from a year ago was also 0.1%, representing the smallest gain in nearly three years. Core producer price rose 2.6% year-over-year.

This Week: Key Economic Data

Tuesday: Retail Sales. Industrial Production.

Wednesday: Housing Starts.

Thursday: Existing Home Sales. Index of Leading Economic Indicators. Jobless Claims.

Source: Econoday, July 14, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Bank of America Corporation (BAC), Lockheed Martin Corporation (LMT), Morgan Stanley (MS), The Charles Schwab Corporation (SCHW), The PNC Financial Services Group, Inc. (PNC), Prologis, Inc. (PLD)

Wednesday: Netflix, Inc. (NFLX), Tesla, Inc. (TSLA), International Business Machines Corporation (IBM), The Goldman Sachs Group, Inc. (GS)

Thursday: Johnson & Johnson (JNJ), Blackstone, Inc. (BX), Intuitive Surgical, Inc. (ISRG), Abbott Laboratories (ABT), American Airlines Group, Inc. (AAL), CSX Corporation (CSX), Freeport-McMoRan, Inc. (FCX), United Airlines Holdings, Inc. (UAL), Capital One Financial Corporation (COF)

Friday: American Express Company (AXP)

Source: Zacks, July 14, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.