The Weekly Update

Week of October 2, 2017

By Christopher T. Much, CFP®, AIF®

Before we begin our usual weekly commentary, we wanted to take a moment to honor the victims of Sunday’s terrible attack in Las Vegas. Though details are still scarce, it is the most devastating mass shooting in U.S. history. Our thoughts are with the victims, their families, and with the community that now must cope with the aftermath of the tragedy. As we look for answers, let’s also remember to be grateful for the ones we love.

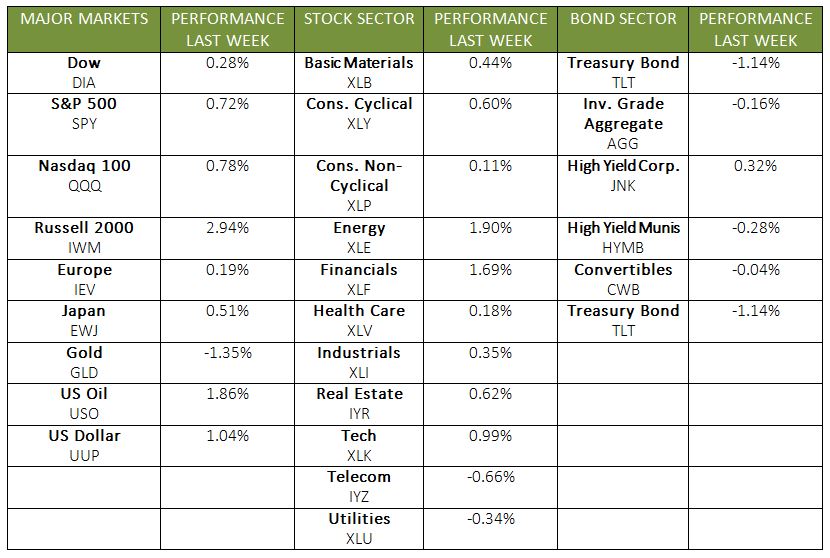

Last week’s final performance of Q3 saw the S&P 500 hit a new high and finish up 0.68%. Meanwhile, the Nasdaq beat previous records with a 1.07% gain, and the Dow notched a 0.25% increase to come within 0.1% of its all-time high. International markets, however, experienced a slight dropthe MSCI EAFE fell 0.19% for the week.

As the country continues its recovery from Hurricanes Harvey, Irma, and Maria, the economy keeps revealing positive strides. A few specific performance factors rounded out the week:

- Small Cap Gains Post Strong Returns

Small cap gains hit record highs last week. Some analysts think the gain is partially a result of President Trump’s proposed tax code changeswhich offers tax cuts to corporations and individuals. Because small cap companies often have limited international resources, they often benefit the most from tax cuts. That said, rising interest rates and a higher dollar are also factors to consider. - Dollar Is on the Rise

The dollar index fell on Friday, but the buck still points towards weekly and monthly highs. Despite dipping after news of slow consumer spending, the greenback responded positively to increases in consumer sentiment and the Chicago Purchasing Managers Index. The Chicago Purchasing Managers Index matters to investors because it measures manufacturing and non-manufacturing activity in the greater Chicagoland area. These numbers tend to closely mirror the rest of the country. - Corporate Earnings Hit New Highs

Corporate earnings are a signifier of how well corporate stocks perform. Last week, earnings posted back-to-back double-digit gains for the first time since 2011. This performance helped push markets beyond geopolitical affairs and concerns from the recent devastation caused by hurricanes.

What Is Ahead?

Markets will continue to watch out for Harvey, Irma, and Maria’s influence on this week’s key economic reports. Analysts expect strong data from manufacturing to vehicle sales, though damages to ports may affect international trade.

Further, we are watching the Fed’s decisions to shrink its balance sheet and raise interest rates. We will also continue following how President Trump’s recent announcement to possibly replace Fed Chair Janet Yellen (whose tenure ends in February) affects the markets.

As always, we continue our focus on helping you meet your long-term goals. If you have any questions as to how last week’s news may affect your portfolio, let us know. We are here to answer questions and help your investment process run smoothly.

ECONOMIC CALENDAR

Monday: PMI Manufacturing Index, ISM Manufacturing Index, Construction Spending

Tuesday: Motor Vehicle Sales

Wednesday: ADP Employment Report, ISM Non-Mfg Index

Thursday: Factory orders

Friday: Employment Situation