The Weekly Update

Week of August 8th, 2022

By Christopher T. Much, CFP®, AIF®

Stocks turned in a mixed performance last week as investors struggled with headlines suggesting that the Fed was unlikely to soon ease up on its current monetary tightening policy.

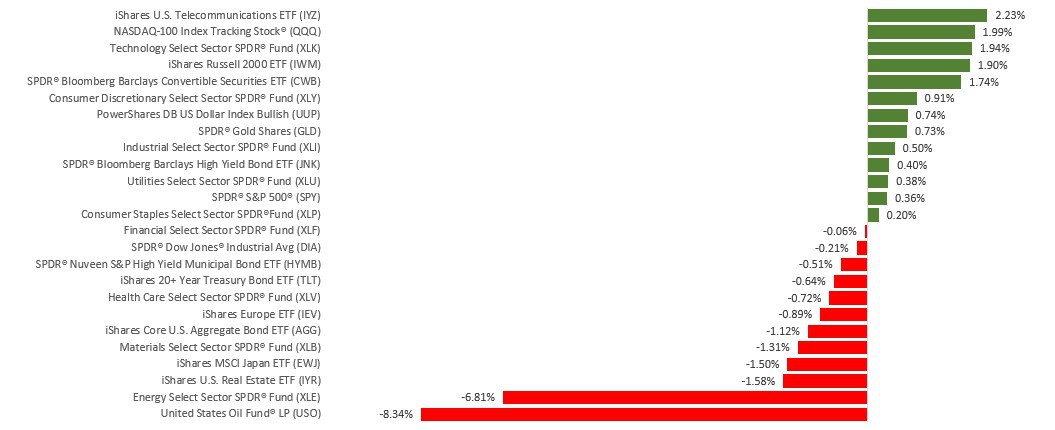

The Dow Jones Industrial Average slipped 0.13%, while the Standard & Poor’s 500 rose 0.36%. The Nasdaq Composite index picked up 2.15% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.23%.

Showing Resilience

Ahead of Friday’s employment report, stocks were generally higher, highlighted by a Wednesday rally triggered by fresh earnings surprises and a better-than-expected economic report. The rally was especially notable because it occurred when multiple Fed officials said that the fight against inflation hadn’t ended, perhaps throwing cold water on the idea that the Fed might pivot due to weakening economic activity and the prospect of cooling inflation.

Aside from this single day of enthusiasm, markets were a bit jittery, especially as investors monitored Speaker of the House Pelosi’s visit to Taiwan. A robust employment report on Friday reinforced the idea that the Fed would likely stay the course on monetary tightening, resulting in a mixed market for the week.

Employment Record

The U.S economy added 528,000 jobs in July, doubling the consensus expectation of 258,000. The unemployment rate ticked lower, falling from 3.6% to 3.5%. Coincident with this job creation was strong wage growth, as average hourly earnings rose 0.5% in July and 5.2% from a year ago.

Leisure and hospitality, professional and business services, and healthcare lead the way in reported job gains, as seen in most sectors of the economy. Even sectors such as construction, particularly vulnerable to rising interest rates, saw job gains. The labor force participation rate moved slightly lower, slipping to 62.1%–its lowest level this year.

This Week: Key Economic Data

Wednesday: Consumer Price Index (CPI). Institute for Supply Management (ISM) Services Index. Factory Orders.

Thursday: Jobless Claims. Producer Price Index (PPI).

Friday: Consumer Sentiment.

Source: Econoday, August 5, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Dominion Energy, Inc. (D), Tyson Foods, Inc. (TSN).

Tuesday: Emerson Electric Co. (EMR).

Wednesday: The Walt Disney Company (DIS).

Thursday: Illumina, Inc. (ILMN).

Source: Zacks, August 5, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.