The Weekly Update

Week of October 31st, 2022

By Christopher T. Much, CFP®, AIF®

Stocks overcame poor earnings results from some of America’s largest companies to post gains last week as investors cheered positive earnings surprises, easing inflation and a rebound in economic growth.

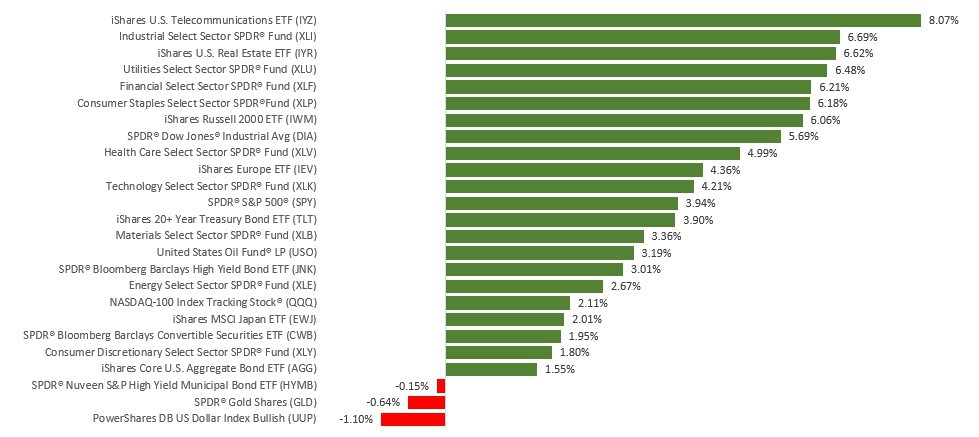

The Dow Jones Industrial Average rose 5.72%, while the Standard & Poor’s 500 advanced 3.95%. The Nasdaq Composite index added 2.24% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 4.89%.

A ‘Spook-Tacular’ Week

Some mega-cap technology companies were under pressure last week on weak earnings and tepid fourth-quarter guidance. They reported multiple headwinds, including declining advertising revenues, loose expense control, and a slowdown in cloud growth.

Meanwhile, positive earnings surprises from “old economy” companies powered markets higher. This market bifurcation was evident in the divergence in the performance of the Dow Industrials and the Nasdaq. The S&P 500 posted a substantial gain despite its disproportionate weighting of mega-cap stocks, which helped illustrate the power of the rally. Momentum accelerated into Friday, aided by an easing in inflation and a solid third-quarter Gross Domestic Product (GDP) report.

Economic Growth Exceeds Expectations

After two straight quarters of negative economic growth, the initial estimate of the third quarter’s GDP came in at a solid 2.6%, exceeding economists’ 2.3% estimate. The surprising economic performance was largely attributable to an increase in exports, which narrowed the trade deficit, a development that may not repeat going forward.

Particularly encouraging was the personal consumption expenditure price index, a report used by the Fed to track inflation. It increased 4.2%, well below the 7.3% jump from a quarter ago.

This Week: Key Economic Data

Tuesday: Institute for Supply Management (ISM) Manufacturing Index. Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Federal Open Market Committee (FOMC) Announcement. Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims. Factory Orders. Institute for Supply Management (ISM) Services Index.

Friday: Employment Situation.

Source: Econoday, October 28, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Pfizer, Inc. (PFE), Eli Lilly & Company (LLY), Marathon Petroleum Corporation (MPC).

Wednesday: CVS Health Corporation (CVS), Qualcomm, Inc. (QCOM), Fortinet, Inc. (FTNT), Humana, Inc. (HUM), Cigna Corporation (CI), Booking Holdings, Inc. (BKNG), Prudential Financial, Inc. (PRU).

Thursday: Block, Inc. (SQ), PayPal Holdings, Inc. (PYPL), Amgen, Inc. (AMGN), ConocoPhillips (COP), Regeneron Pharmaceuticals, Inc. (REGN).

Friday: Dominion Energy, Inc. (D), EOG Resources, Inc. (EOG).

Source: Zacks, October 28, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.