The Weekly Update

Week of September 10, 2018

By Christopher T. Much, CFP®, AIF®

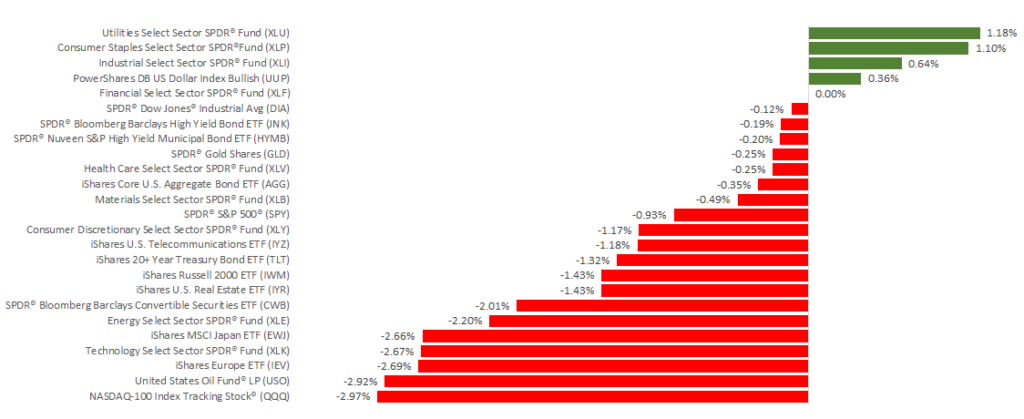

Domestic markets fell last week due to negative trade news and declining tech stocks, with the S&P 500 and Dow both breaking their multi-week winning streaks. Meanwhile, the NASDAQ posted losses for 4 days in a row for the first time since April and experienced its worst September start since 2008. Overall, the S&P 500 lost 1.03%, the Dow dropped 0.19%, and the NASDAQ gave back 2.55% for the week. International stocks in the MSCI EAFE also declined, losing 2.89%.

The Cboe Volatility Index (VIX), which can help gauge market fears, increased 15.8% last week. This increase matches what often occurs during September, when volatility returns after waning during the summer months. In fact, since 2007, volatility has been above average in September.

Of course, the change from one month or season to another isn’t enough to trigger market losses and rising volatility. Let’s analyze what drove these experiences last week.

- Trade tension escalated between the U.S. and China.

The U.S. is getting closer to resolving trade issues with Mexico, Canada, and the European Unionand the countries may unite against China’s trade approach. As a result, the likelihood of calming the trade dispute between the U.S. and China is fading. Last week, President Trump said he was prepared to add tariffs to another $267 billion in Chinese goods. These tariffs would be in addition to the $200 billion that may launch soon, which one expert said could reduce the S&P 500 by 5%. - Tech stocks dropped.

Last week, the technology sector declined by 2.9%. Tech has performed better than any other sector this year and has been a market leader for 3 years. But concerns about increasing regulation—with a focus on social media companies—weighed on investors’ minds last week. - Wage growth increased.

The latest jobs report surpassed expectations, with the economy adding 201,000 jobs in August. Year-over-year wage growth also rose more than expected and hit its fastest pace since 2009. This wage increase contributed to stock losses, because it could mean that 2018 will have 2 additional interest rate increaseswith more on the horizon for 2019.

Last week certainly provided data and headlines for investors to digest. But the job market, economic fundamentals, and markets remain strong. For the moment, we’ll continue to review the data we receive and seek new ways to help you prepare for what lies ahead.

ECONOMIC CALENDAR:

Tuesday: JOLTS

Thursday: CPI, Jobless Claims

Friday: Retail Sales, Industrial Production, Consumer Sentiment