The Weekly Update

Week of April 22, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

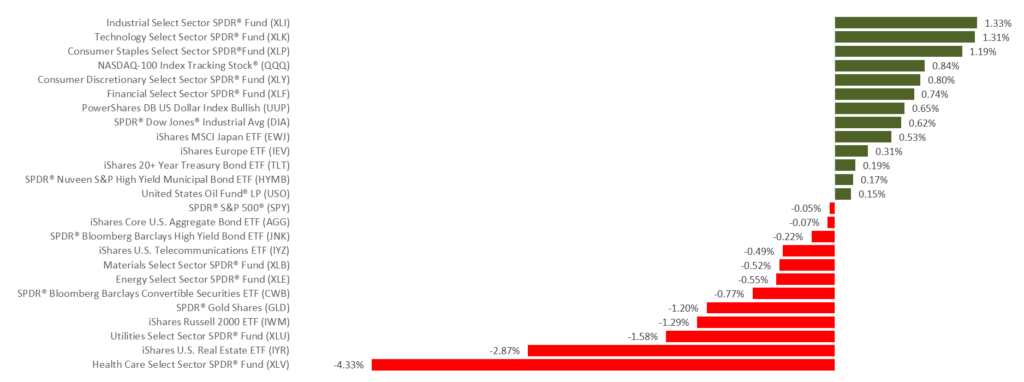

A short and relatively placid trading week wrapped up Thursday, with the major indices turning in mixed performances. The S&P 500 retreated 0.08%, the Nasdaq Composite advanced 0.17%, and the Dow Jones Industrial Average gained 0.56%. The MSCI EAFE index, tracking foreign stocks in developed countries, added 0.65%.

Nothing really catalytic emerged to drive the market last week, and volumes were low.

Earnings Season Update

More than 78% of S&P 500 firms reporting so far this earnings season have surpassed analyst expectations, according to FactSet. Since guidance tends to be conservative, there is the possibility that more companies will beat forecasts than expected.

The initial public offering market remained strong. Two high-profile technology companies came public on Thursday and were met with enthusiasm from investors. As mentioned in recent weeks, 2019 could be a banner year for IPOs.

Retail Sales Rebound

March’s 1.6% gain was the biggest monthly advance seen since September 2017. Sales of cars and gasoline rose more than 3%.

If the upcoming March consumer spending report is also impressive, concerns about the current business cycle peaking may recede.

Final Thought

Nearly 800 companies will report earnings this week, including some high-profile names. This kicks off five weeks of active daily earnings reports.

Investors will watch corporate profits, guidance, and fundamental indicators with great interest, to try and glean whether the economy is strengthening or softening. Reports on first-quarter economic growth and existing home sales will command particular attention.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: March existing home sales figures from the National Association of Realtors.

Tuesday: March new home sales numbers from the Census Bureau.

Friday: The first estimate of first-quarter gross domestic product (GDP) from the federal government, and the final April University of Michigan consumer sentiment index, a gauge of consumer confidence levels.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Halliburton (HAL), Kimberly-Clark (KMB), Whirlpool (WHR)

Tuesday: Coca-Cola (KO), Harley-Davidson (HOG), Procter & Gamble (PG), Twitter (TWTR), Verizon (VZ)

Wednesday: Anthem (ANTM), Boeing (BA), Caterpillar (CAT), Facebook (FB)

Thursday: 3M (MMM), AbbVie (ABBV), Amazon (AMZN), Starbucks (SBUX)

Friday: American Airlines (AAL), Colgate-Palmolive (CL), ExxonMobil (XOM)