The Weekly Update

Week of October 19th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks treaded water last week amid fading prospects for a stimulus bill, fears of a second wave of COVID-19 cases and increasing political and regulatory pressures on Big Tech companies.

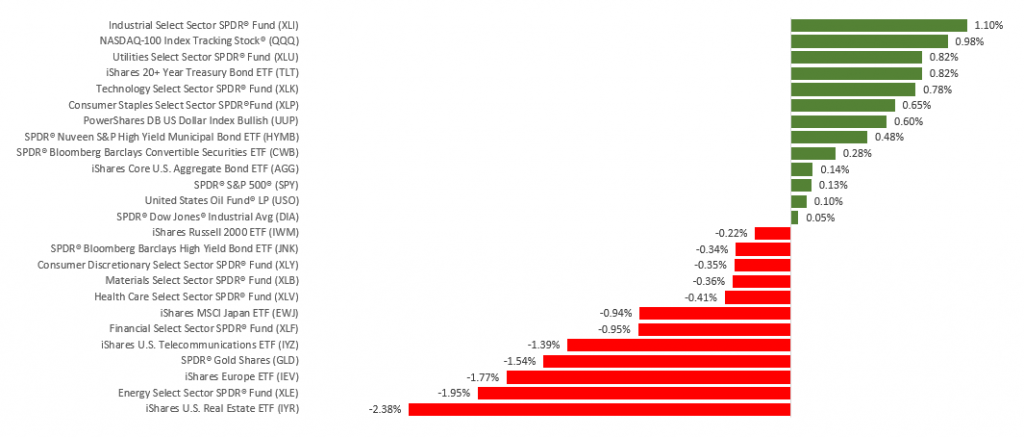

The Dow Jones Industrial Average added just 0.07% while the Standard & Poor’s 500 eked out a gain of 0.19%. The Nasdaq Composite index picked up 0.79% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slid 2.08%.

Rocky Week

The stock market began the week by posting strong gains on hopes of a fiscal stimulus bill. Also, investors were optimistic that earnings season would reflect an improving picture of corporate performance.

But stocks stumbled midweek on a mixed bag of early earnings results, and an increase in COVID-19 cases in the U.S. and Europe. Disappointing news on some key COVID-19 treatment trials also weighed on the market, as did a jump in new jobless claims and a continued stalemate on a fiscal stimulus package.

Stocks attempted to rally on Friday, emboldened by strong retail sales, but lost momentum as trading came to a close.

Earnings Season Kicks Off

Earnings season began on an upbeat note as major banks mostly beat on revenue and profit expectations. Banks attributed the strength to rising consumer deposits, a drop in the amount of money set aside for failing loans, and strong results from their investment banking and trading units.

Airlines fared less well. Investors were disappointed with the quarterly reports even though the average daily cash burn at these companies generally improved. Airline management uniformly accompanied their earnings announcements with warnings of continued near-term weakness due to COVID-19.

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Housing Starts.

Thursday: Jobless Claims. Existing Home Sales. Index of Leading Economic Indicators.

Source: Econoday, October 16, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Halliburton (HAL), PPG Industries (PPG), International Business Machines (IBM)

Tuesday: Netflix (NFLX), Lockheed Martin (LMT), Procter & Gamble (PG), Snap (SNAP), Texas Instruments (TXN)

Wednesday: Verizon (VZ), Abbott Laboratories (ABT), CSX Corp. (CSX), Chipotle Mexican Grill (CMG)

Thursday: AT&T (T), Intel Corp. (INTC), Coca Cola Co. (KO), American Airlines (AAL), Southwest Airlines (LUV)

Friday: American Express (AXP)

Source: Zacks, October 16, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.