The Weekly Update

Week of November 17th, 2025

By Christopher T. Much, CFP®, AIF®

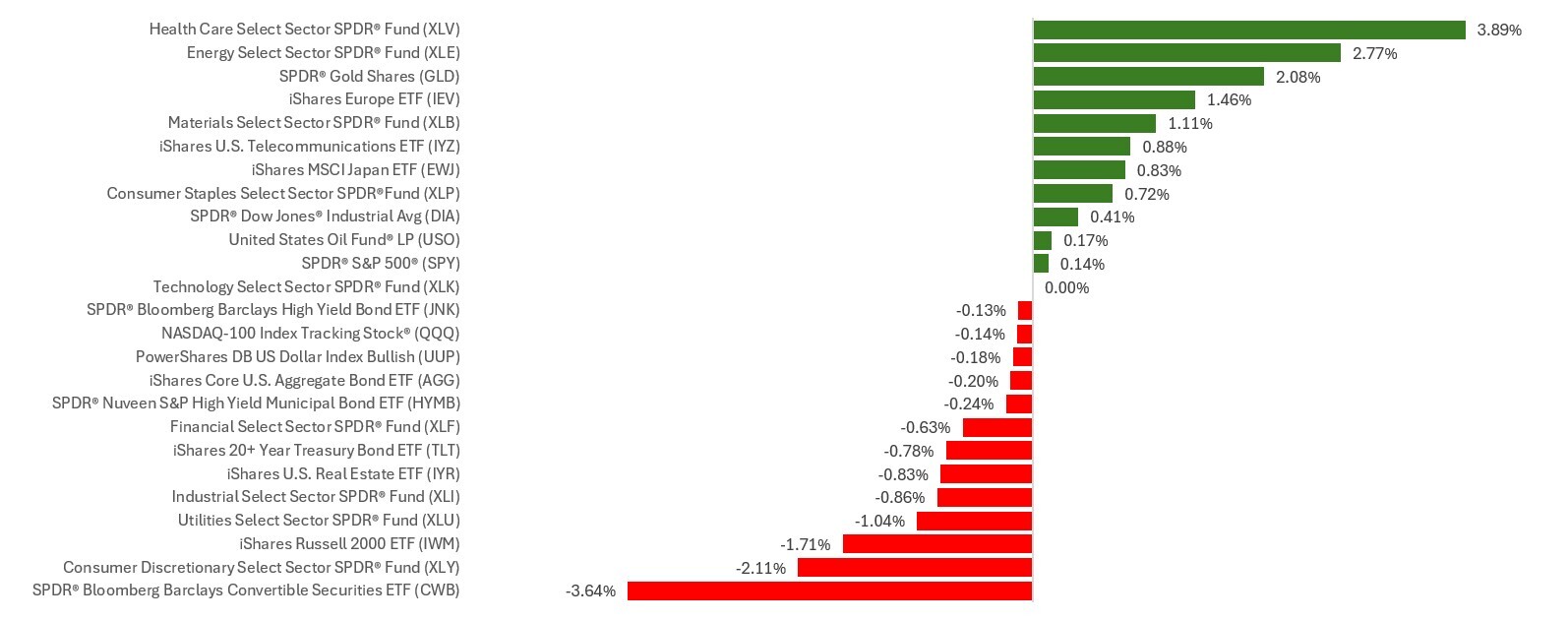

Stocks ended mixed after a nail-biting week for investors, who grew anxious over megacap tech valuations and interest rates as the government shutdown came to an end.

The Standard & Poor’s 500 Index edged up 0.08 percent, while the Nasdaq Composite Index slipped 0.45 percent. The Dow Jones Industrial Average rose 0.34 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, advanced 1.63 percent.

Rotating into Value

The week began with stocks rising, fueled by hopes that the longest-ever government shutdown could soon end as a federal funding bill moved closer to Congressional approval. Building on these early gains, the Nasdaq advanced more than 2 percent and the S&P 500 added 1½ percent.

Stocks rose at the opening bell on Tuesday following news that the Senate had passed a bill to end the shutdown, but sentiment quickly turned as tech stocks pulled down the Nasdaq and S&P. Meanwhile, the Dow rose modestly. However, by midday, sentiment shifted positively, and the Dow and S&P 500 closed in the green.

Midweek, growing conviction that the government would reopen continued to push the Dow Industrials higher. As a result, the Dow achieved its first record close above 48,000, with the S&P remaining flat and the Nasdaq slipping. Once the government reopened Thursday morning, attention quickly turned to tech valuations and an earnings miss from a large entertainment conglomerate. This shift also prompted investors to worry whether the Fed would adjust interest rates next month. Despite a brief dip as the week concluded, markets stabilized, with the Nasdaq and S&P recovering near the flatline, while the Dow lagged slightly.

Restarting the Data Engine

It takes time to get a tanker ship up and running again after a full stop. That’s what the Bureau of Labor Statistics (BLS) is doing now, as the government stats engine resumes.

Using the last government shutdown (in 2013) as a baseline, about half of the BLS reports that have not yet been published could be ready by the Federal Reserve’s next meeting on December 9-10. The remainder of the backlogged reports (including October reports) are estimated to be published on a rolling basis through mid-January.

This Week: Key Economic Data

Monday: Fed officials Philip Jefferson, Neel Kashkari, and Christopher Waller speak.

Tuesday: Import Prices (October). Industrial Production (October). Capacity Utilization (October). Home Builder Confidence Index. Fed governor Michael Barr speaks.

Wednesday: Housing Starts (October). Building Permits (October). Federal Open Market Committee (FOMC) Minutes, October meeting.

Thursday: Weekly Jobless Claims. Existing Home Sales (October). Leading Economic Indicators (October). Fed governor Lisa Cook and Fed Presidents Austan Goolsbee (Chicago) and Anna Paulson (Philadelphia) speak.

Friday: Fed governor Michael Barr, Fed Vice Chair Philip Jefferson, and Dallas Fed President Lorie Logan speak. Purchasing Managers Index (PMI) Survey—Services. Purchasing Managers Index (PMI) Survey—Manufacturing. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; November 14, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The Home Depot, Inc. (HD)

Wednesday: NVIDIA Corporation (NVDA), The TJX Companies, Inc. (TJX), Palo Alto Networks, Inc. (PANW), Lowe’s Companies, Inc. (LOW)

Thursday: Walmart Inc. (WMT), Intuit Inc. (INTU), NetEase, Inc. (NTES)

Source: Zacks, November 14, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.