The Weekly Update

Week of November 3rd, 2025

By Christopher T. Much, CFP®, AIF®

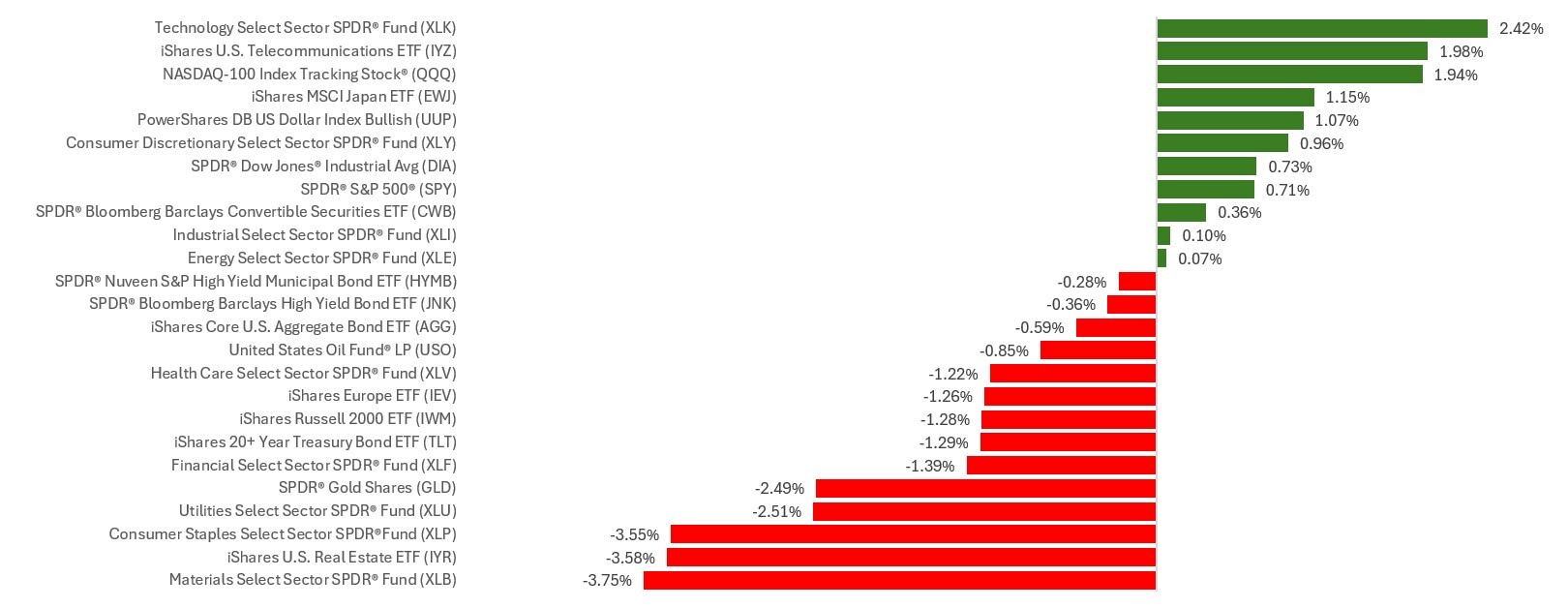

Stocks rose last week as trade developments, positive Q3 corporate results, and momentum in megacap tech drove another rally, despite some cautious comments from the Fed.

The Standard & Poor’s 500 Index gained 0.71 percent, while the tech-heavy Nasdaq Composite Index picked up 2.24 percent. The Dow Jones Industrial Average rose 0.75 percent. By contrast, the MSCI EAFE Index, which tracks developed overseas stock markets, fell 0.55 percent.

Stocks Up for Third Straight Week

Stocks rose over the first half of the week on news that Chinese and U.S. officials were working on a trade deal. Meanwhile, a rise in AI-related tech names lifted the broader market ahead of the Federal Open Market Committee (FOMC) meeting. All three major averages notched record closing highs for the first two days of the week, including the S&P 500 closing above 6800 for the first time.

Stocks continued their rise Wednesday morning as the AI trade continued to fuel momentum. But markets wobbled following the FOMC’s decision to cut interest rates by a quarter percentage point. Chair Powell’s comments that the Fed may not adjust rates in December cut short the market’s rally.

Stocks bounced out of the gate on Friday, with the Nasdaq leading gains for all three major averages as several megacap tech companies rallied on upbeat Q3 results and other corporate news.

‘Not a Foregone Conclusion’

As widely expected, the Federal Reserve cut short-term interest rates by 0.25 percent. But as often happens for those trying to read the Fed tea leaves, it was the finer messaging points that moved the markets.

Fed Chair Jerome Powell said in his post-meeting press conference that another rate adjustment in December was “not a foregone conclusion.” He added that Fed policy is “not on a pre-set course.” Part of that, he said, was due to the ongoing government shutdown and the resulting dearth of economic data—and the challenge in setting monetary policy without ongoing reports.

This Week: Key Economic Data

Monday: PMI Composite–Manufacturing. ISM Manufacturing. Construction Spending.* Auto Sales. Fed governor Lisa Cook speaks.

Tuesday: Trade Deficit.* Factory Orders. Job Openings.

Wednesday: ADP Employment Report. PMI Composite–Services. ISM Services.

Thursday: Weekly Jobless Claims.* Productivity.* Wholesale Inventories.* Federal Reserve Officials speak: New York Fed President Williams, Philadelphia Fed President Paulson, St. Louis Fed President Musalem.

Friday: Jobs Report.* Consumer Sentiment. Consumer Credit. Dallas Fed President Logan speaks.

Source: Investor’s Business Daily – Econoday economic calendar; October 31, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Welltower Inc. (WELL), Cadence Design Systems, Inc. (CDNS), Waste Management, Inc. (WM)

Tuesday: Visa Inc. (V), United Health Group Incorporated (UNH), NextEra Energy, Inc. (NEE), Booking Holdings Inc. (BKNG), Southern Copper Corporation (SCCO), American Tower Corporation (AMT)

Wednesday: Microsoft Corporation (MSFT), Alphabet Inc. (GOOG/GOOGL), Meta Platforms, Inc. (META), Caterpillar Inc. (CAT), ServiceNow, Inc. (NOW), Verizon Communications Inc. (VZ), The Boeing Company (BA), KLA Corporation (KLAC), Automatic Data Processing, Inc. (ADP), CVS Health Corporation (CVS), Starbucks Corporation (SBUX)

Thursday: Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), Eli Lilly and Company (LLY), MasterCard Incorporated (MA), Merck & Co., Inc. (MRK), Gilead Sciences Inc. (GILD), Stryker Corporation (SYK), S&P Global Inc. (SPGI), Comcast Corporation (CMCSA), Altria Group, Inc. (MO), The Southern Company (SO)

Friday: Exxon Mobil Corporation (XOM), AbbVie Inc. (ABBV), Chevron Corporation (CVX)

Source: Zacks, October 24, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.