The Weekly Update

Week of October 27th, 2025

By Christopher T. Much, CFP®, AIF®

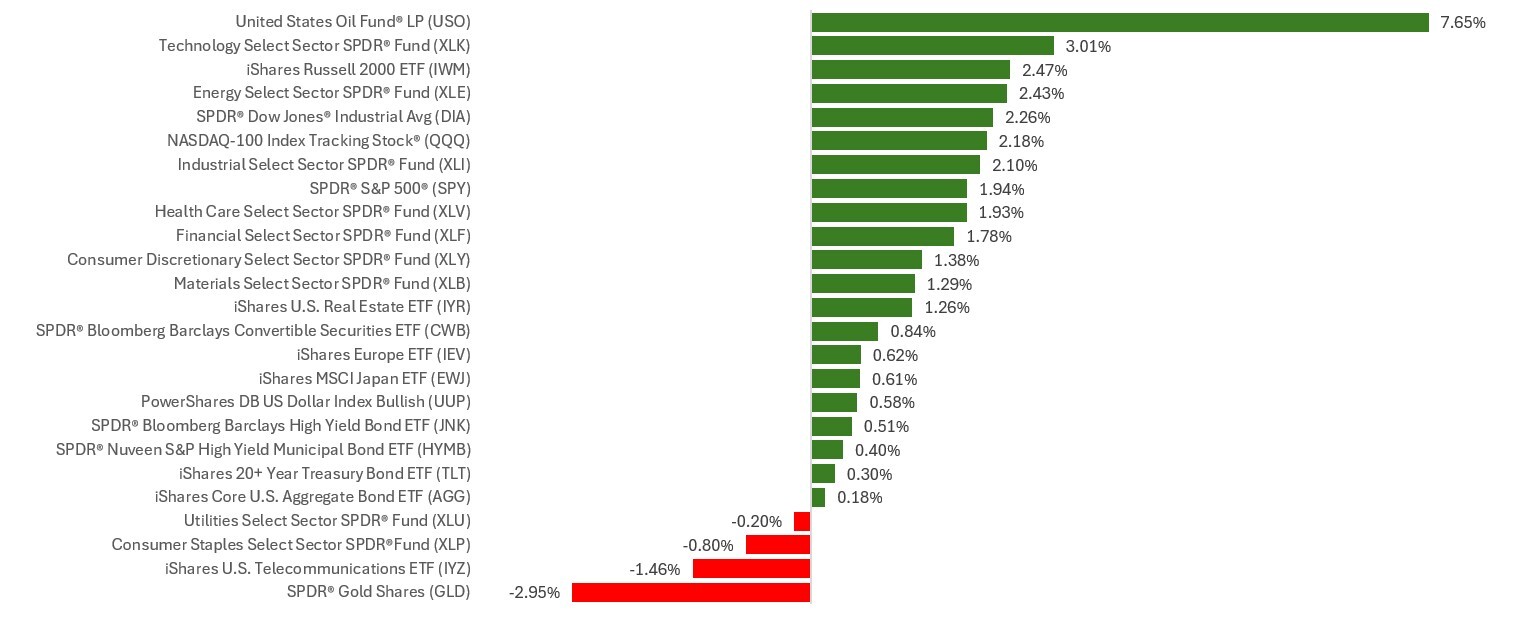

Stocks rose last week thanks to a full slate of upbeat third-quarter corporate results and mild inflation data, which helped soften concerns over trade tensions with China.

The Standard & Poor’s 500 Index gained 1.92 percent, while the Nasdaq Composite Index rose 2.31 percent. The Dow Jones Industrial Average advanced 2.20 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 1.24 percent.

S&P, Dow Set New Highs on Friday

Stocks rose out of the gate as optimism returned to markets. Strength in the tech sector—and whispers of an imminent end to the government shutdown—pushed all three market averages higher.

But the strong start turned mixed as some pressure on megacap tech stocks pulled down the Nasdaq. But while tech stocks regrouped, attention shifted to the Dow Industrials, which hit a record intraday high of 47,000 and a record close.

Sentiment soured midweek as weaker-than-expected earnings results from two megacap tech companies dragged down technology names. Markets came under further pressure following news that the administration was considering restrictions on U.S.-made software exported to China. The S&P, Dow, and Nasdaq all closed lower on Wednesday.

But the mood brightened Thursday as more megacap tech companies announced strong Q3 results, and as the White House confirmed a scheduled meeting with China.

News on Friday that inflation rose more slowly than expected boosted all three averages. The S&P 500 and Dow Industrials hit all-time intraday and closing highs.

Inflation Eases

The Consumer Price Index report, delayed due to the government shutdown, showed prices rose by 3.0 percent in September on an annualized basis, slightly cooler than the 3.1 percent forecast.

This news paved the way for the Fed to stick with its penciled-in rate cut at its two-day meeting, which ends on October 29.

In addition to the upbeat inflation news, Q3 corporate earnings–one of the key drivers of stock prices–have been beating expectations 80% of the time as of Friday.

This Week: Key Economic Data

Monday: Durable Goods.

Tuesday: Case-Shiller Home Price Index. Consumer Confidence.

Wednesday: Trade Balance in Goods. Retail & Wholesale Inventories. Pending Home Sales. Federal Open Market Committee meeting, Day 2. Fed Interest Rate Decision. Fed Chair Press Conference.

Thursday: Gross Domestic Product (GDP). Weekly Jobless Claims. Fed Official Michelle Bowman speaks.

Friday: Personal Consumption & Expenditures (PCE) Index. Dallas Fed President Logan, Cleveland Fed President Hammack, and Atlantic Fed President Bostic speak.

Source: Investor’s Business Daily – Econoday economic calendar; October 24, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Welltower Inc. (WELL), Cadence Design Systems, Inc. (CDNS), Waste Management, Inc. (WM)

Tuesday: Visa Inc. (V), United Health Group Incorporated (UNH), NextEra Energy, Inc. (NEE), Booking Holdings Inc. (BKNG), Southern Copper Corporation (SCCO), American Tower Corporation (AMT)

Wednesday: Microsoft Corporation (MSFT), Alphabet Inc. (GOOG/GOOGL), Meta Platforms, Inc. (META), Caterpillar Inc. (CAT), ServiceNow, Inc. (NOW), Verizon Communications Inc. (VZ), The Boeing Company (BA), KLA Corporation (KLAC), Automatic Data Processing, Inc. (ADP), CVS Health Corporation (CVS), Starbucks Corporation (SBUX)

Thursday: Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), Eli Lilly and Company (LLY), MasterCard Incorporated (MA), Merck & Co., Inc. (MRK), Gilead Sciences Inc. (GILD), Stryker Corporation (SYK), S&P Global Inc. (SPGI), Comcast Corporation (CMCSA), Altria Group, Inc. (MO), The Southern Company (SO)

Friday: Exxon Mobil Corporation (XOM), AbbVie Inc. (ABBV), Chevron Corporation (CVX)

Source: Zacks, October 24, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.