The Weekly Update

Week of July 14th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks were slightly lower last week, while looking past news of fresh U.S. tariffs on nearly two dozen countries.

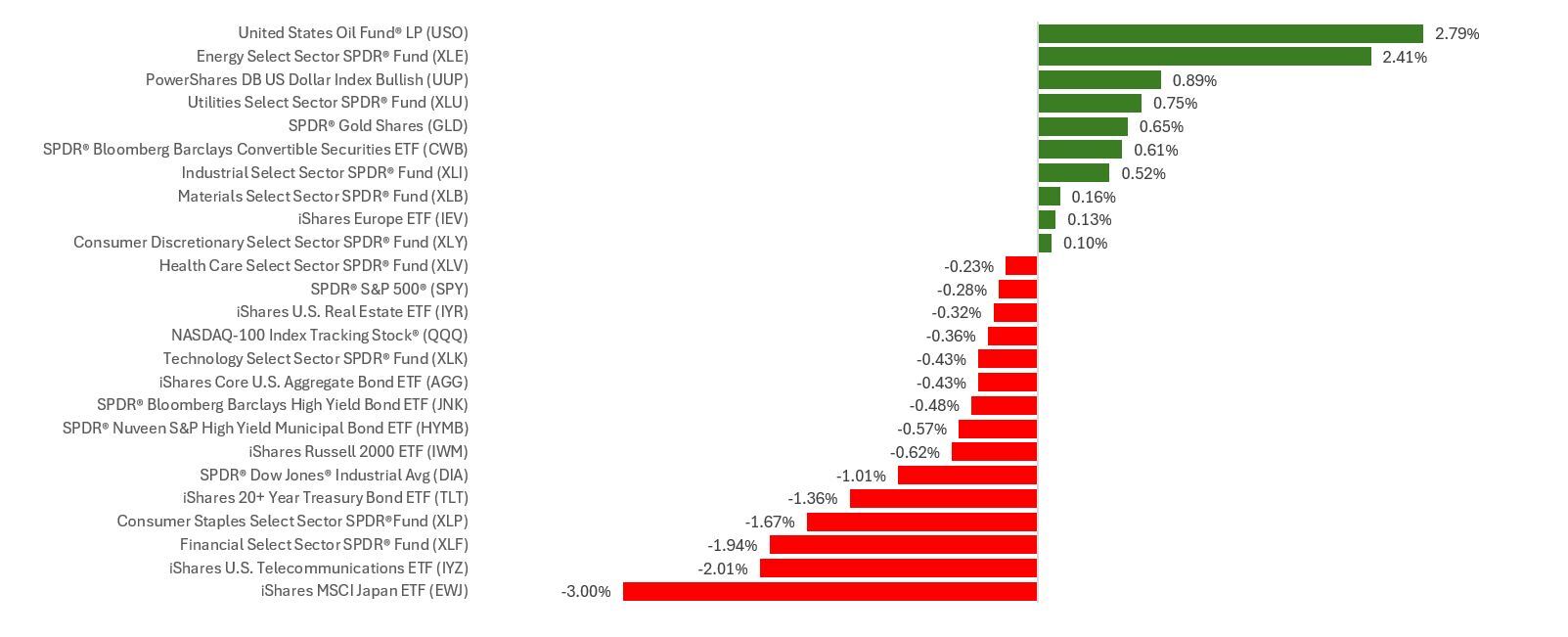

The Standard & Poor’s 500 Index fell 0.31 percent, while the Nasdaq Composite Index edged lower by 0.08 percent. The Dow Jones Industrial Average lost 1.02 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slipped 0.43 percent.

The Return of the Tariffs

Stocks started the week lower after the White House posted letters to 14 countries announcing new tariffs set to take effect August 1. They included 25 percent tariffs on South Korea and Japan.

Stocks dropped briefly midweek after the White House announced tariffs on seven additional countries. But as investors digested the news, markets gradually recovered, hoping the administration would dial back its steepest tariff rates again.

Markets also rallied on fresh AI trade enthusiasm and the latest Fed meeting minutes, which showed a majority of Committee members were open to adjusting interest rates later this year.

Markets opened higher on Thursday as investors shrugged off news of the 50 percent tariff on Brazil imports, announced shortly after Wednesday’s close. Momentum continued, and the S&P 500 and Nasdaq rose to fresh records.

Then, after Thursday’s close, the White House announced the U.S. was raising tariffs on Canadian imports to 35 percent and was preparing some other tariffs. Markets opened lower on Friday and trended sideways during the trading session.

The T Word

While tariffs drove market headlines last week, another “t word” made news: trillion.

More specifically, $4 trillion in market capitalization. The nation’s largest AI chip maker was the first company to breach that market cap level. It crossed the $4 trillion mark intraday on Wednesday, then closed above it for the first time on Thursday’s close.

So why does it matter when one stock hits such a milestone? For a market-cap weighted index like the S&P 500, a company valued at $4 trillion has an outsized effect on the overall index’s performance. The largest five companies in the S&P 500 comprise about one-third of the benchmark index.

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI). Industrial Production. Capacity Utilization. Boston Fed President Susan Collins and Dallas Fed President Lorie Logan speak.

Wednesday: Producer Price Index (PPI). Fed Beige Book.

Thursday: Jobless Claims (weekly). Retail Sales. Import Price Index. Business Inventories. Home Builder Confidence Index.

Friday: Housing Starts. Building Permits. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; July 11, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), BlackRock (BLK), Citigroup Inc. (C)

Wednesday: Johnson & Johnson (JNJ), Bank of America Corporation (BAC), Morgan Stanley (MS), The Goldman Sachs Group, Inc. (GS), The Progressive Corporation (PGR), Prologis, Inc. (PLD)

Thursday: Netflix, Inc. (NFLX), GE Aerospace (GE), Abbott Laboratories (ABT), PepsiCo, Inc. (PEP), Marsh & McLennan Companies, Inc. (MMC), Interactive Brokers Group, Inc. (IBKR)

Friday: American Express Company (AXP), The Charles Schwab Corporation (SCHW)

Source: Zacks, July 11, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.