The Weekly Update

Week of June 16th, 2025

By Christopher T. Much, CFP®, AIF®

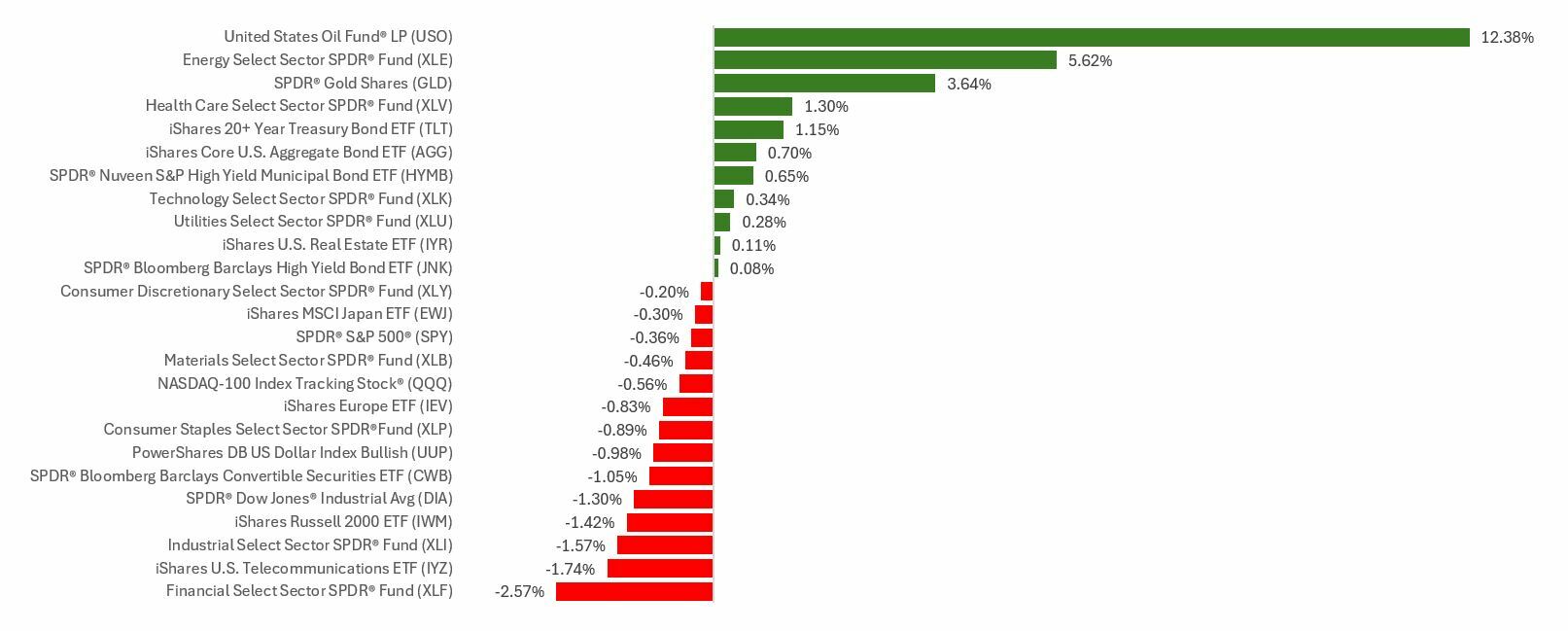

Stocks fell last week as an up-and-down mix of trade progress and anxiety, economic news, and geopolitical tensions netted out.

The Standard & Poor’s 500 Index slid 0.39 percent, while the Nasdaq Composite Index slipped 0.63 percent. The Dow Jones Industrial Average declined 1.32 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, edged down 0.18 percent.

Trade, Geopolitics Dominate Sessions

Stocks largely languished for the first half of the week as investors awaited news from U.S.-China trade talks and key inflation reports.

Sentiment began to rise late Tuesday afternoon following upbeat comments about trade talks. Most of the market gains came before the U.S. and China separately announced the trade update, with little reaction when markets opened the next day.

Stocks peaked midweek, then declined despite a May report showing consumer inflation rose less than expected. Markets then trended a bit higher after a better-than-expected wholesale inflation report.

Beginning Friday morning, all three averages were under pressure all day following news of an escalated conflict in the Middle East. Oil prices pushed higher on Friday on supply concerns.

Brighter Notes

As the week ended with rising tensions in the Middle East, it was easy to overlook some good economic news.

First is inflation: both the Consumer Price Index (CPI) and the Producer Price Index (PPI) showed signs of cooling or holding steady. And both the CPI and PPI slightly beat expectations.

Second, consumers. Consumer sentiment jumped in May—the first such rise in six months. Economists took note, as consumer spending drives two-thirds of the U.S. economy.

This Week: Key Economic Data

Tuesday: Retail Sales. Industrial Production. Capacity Utilization. Business Inventories. Homebuilder Confidence Index. Federal Open Market Committee (FOMC) Meeting, Day 1.

Wednesday: Housing Starts. Building Permits. Jobless Claims (weekly). Federal Open Market Committee (FOMC) Meeting, Day 2. Fed Chair Powell Press Conference.

Friday: Leading Economic Indicators.

Source: Investor’s Business Daily – Econoday economic calendar; June 13, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

No major U.S. companies are reporting this week.

Source: Zacks, June 13, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.