The Weekly Update

Week of May 12th, 2025

By Christopher T. Much, CFP®, AIF®

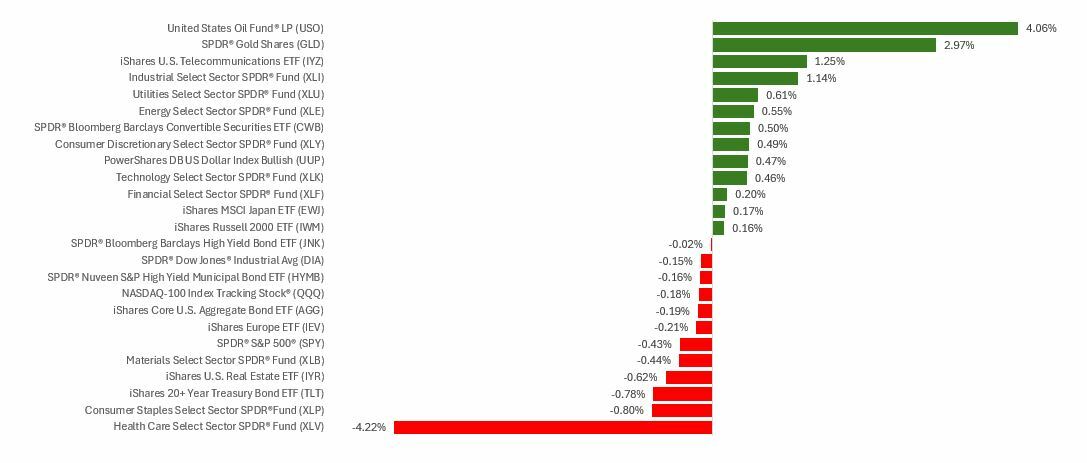

Stocks were mixed last week as volatility dropped despite ongoing trade concerns and the Federal Reserve’s update on short-term rates.

The Dow Jones Industrial Average added 0.16 percent, while the Standard & Poor’s 500 Index lost 0.47 percent. The tech-heavy Nasdaq Composite Index slipped 0.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 0.37 percent.

Stocks Go Sideways

Stocks dropped on Monday, ending the S&P 500’s 9-day winning streak as the trade anxiety weighed on investors.

Sentiment picked up midweek, however. In a widely expected move, the Fed held short-term interest rates steady but warned of lingering uncertainty around tariffs’ effects on inflation and unemployment.

On Thursday, the U.S.-U.K. trade deal sparked a slight rally, but stocks flattened as the week ended. Investors appeared to be risk-averse with U.S.-China trade talks scheduled for the weekend.

The Fed Fans Out

The Federal Reserve wanted to get its message out last week. Within 48 hours of the Fed’s decision to leave interest rates unchanged, nearly every Fed governor gave a solo speech or discussed the decision on a panel.

One Fed official spoke about the benefits of long-term stability from an independent Fed. At the same time, another said the Fed was paying close attention to what consumers did—and not just what they said, suggesting that flagging consumer sentiment didn’t necessarily mean a slowdown in spending.7

The Fed seemed to focus on managing expectations. Perhaps more importantly, Fed officials spoke from a coordinated playbook, possibly designed to help settle financial markets.

This Week: Key Economic Data

Monday: Federal Budget.

Tuesday: Consumer Price Index (CPI). NFIB Small Business Optimism Index.

Wednesday: San Francisco Fed President Mary Daly speaks.

Thursday: Retail Sales. Jobless Claims (weekly). Producer Price Index (PPI). Industrial Production. Business Inventories. Home Builder Confidence Index.

Friday: Import Price Index. Housing Starts. Building Permits. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; May 9, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Cisco Systems, Inc. (CSCO)

Thursday: Walmart Inc. (WMT), Deere & Company (DE), Applied Materials, Inc. (AMAT), NetEase, Inc. (NTES)

Source: Zacks, May 9, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.