The Weekly Update

Week of May 5th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks pushed higher last week as investors cheered the White House’s constructive comments on trade, upbeat Q1 corporate reports, and an encouraging jobs report.

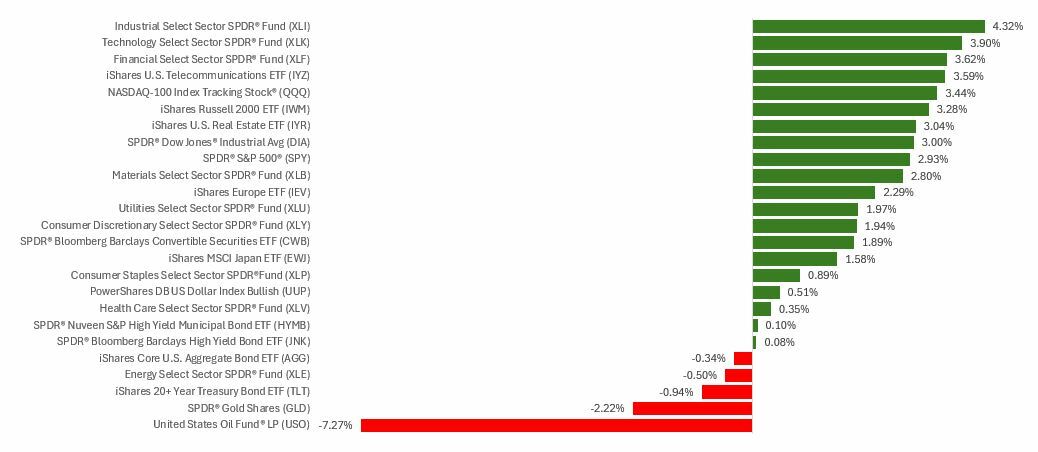

The Standard & Poor’s 500 Index gained 2.92 percent, while the Nasdaq Composite Index rose 3.42 percent. The Dow Jones Industrial Average added 3.00 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, advanced 2.56 percent.

Longest Winning Streak in 20 Years

During the first two trading days, stocks increased as investors responded favorably to White House comments on tariff deals.

Then midweek—on the last day of the month—fresh data showed the economy contracted by 0.3 percent in Q1—the first decline in gross domestic product (GDP) in three years. Stocks initially fell on the news but staged a stunning recovery to add a seventh day to the S&P 500’s and Dow Industrial’s winning streaks.

Q1 corporate reports from a couple of mega-cap tech companies boosted all three major averages over the next session, with Nasdaq leading the rise. By Thursday’s close, Nasdaq had returned to its pre-April 2 levels.

The rally accelerated on Friday as a better-than-expected April jobs report eased some concerns about the economy’s strength. Signs of a potential thaw in Washington-Beijing trade relations also boosted enthusiasm. The Dow Industrials rose for a ninth straight session, as did the S&P 500—its longest winning streak in 20 years.

Solid Jobs Report

The April jobs report showed employers added 177,000 jobs last month—34,000 more than economists expected.

The report quieted talk about a recession, which was welcomed news. The April figure also showed the economy was still adding jobs despite a sluggish Q1 GDP report. However, the strong report did prompt some traders to push out expectations for an interest rate adjustment until the Fed’s July meeting.

This Week: Key Economic Data

Monday: ISM Services Index. PMI Composite (final).

Tuesday: Trade Deficit. FOMC meeting – Day 1.

Wednesday: FOMC meeting – Day 2. Fed Decision / Fed Chair Powell Press Conference. Consumer Credit.

Thursday: Jobless Claims. Productivity & Costs. Wholesale Inventories. Fed Balance Sheet.

Friday: Fed Officials speak: Austan Goolsbee (Chicago Fed President), John Williams (New York Fed President) and Beth Hammack (Cleveland Fed President).

Source: Investor’s Business Daily – Econoday economic calendar; May 2, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Palantir Technologies Inc. (PLTR), Vertex Pharmaceuticals Incorporated (VRTX)

Tuesday: Advanced Micro Devices, Inc. (AMD), Arista Networks, Inc. (ANET), Duke Energy Corporation (DUK)

Wednesday: Uber Technologies, Inc. (UBER), The Walt Disney Company (DIS), AppLovin Corporation (APP)

Thursday: Shopify Inc. (SHOP), ConocoPhillips (COP), McKesson Corporation (MCK)

Source: Zacks, May 2, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.