The Weekly Update

Week of September 30th, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks retreated last week. Traders worried that the formal impeachment inquiry of President Donald Trump might distract White House officials from their pursuit of a trade deal with China and shift the focus of Congress away from consideration of the United States-Mexico-Canada Agreement (USMCA). Also, news broke Friday that the White House was considering restricting levels of U.S. investment in Chinese firms.

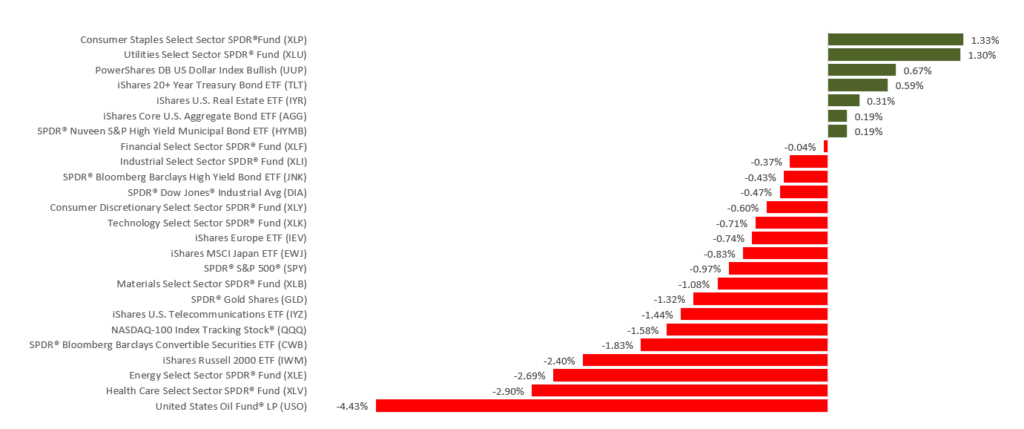

The Dow Jones Industrial Average lost less than the Nasdaq Composite and S&P 500. Blue chips declined 0.43% week-over-week, while the S&P fell 1.01% and the Nasdaq dipped 2.19%. The MSCI EAFE index, tracking developed overseas stock markets, lost 0.89%. , ,

Incomes Grow, Spending Slows

Data released Friday by the Bureau of Economic Analysis showed household incomes rising 0.4% in August. Consumer spending improved just 0.1%, however; that was the smallest personal spending advance in six months.

Another BEA report noted that “real” consumer spending (that is, consumer spending adjusted for inflation) rose 4.6% during the second quarter. ,

A Slip in Consumer Confidence

The Conference Board’s Consumer Confidence Index fell to 125.1 for September. That compares to a reading of 134.2 in August. Lynn Franco, the CB’s director of economic indicators, wrote that “the escalation in trade and tariff tensions in late August appears to have rattled consumers. However, this pattern of uncertainty and volatility has persisted for much of the year and it appears confidence is plateauing.”

In contrast, the University of Michigan’s Consumer Sentiment Index ended September at 93.2, an improvement from a final August mark of 89.8. ,

What’s Ahead

On October 10, the Social Security Administration is scheduled to announce the 2020 cost of living adjustment (COLA) for Social Security retirement benefits. Earlier this month, Bureau of Labor Statistics yearly inflation data pointed to a possible 2020 COLA in the range of 1.6%-1.7%.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Institute for Supply Management presents its September Purchasing Managers Index for the factory sector, a barometer of U.S. manufacturing health.

Wednesday: ADP, the payroll processor, releases its September National Employment Report.

Thursday: ISM’s non-manufacturing PMI arrives, reporting on the state of the U.S. service sector.

Friday: The Department of Labor’s September jobs report appears, and Federal Reserve Chairman Jerome Powell gives a keynote speech at a Fed event in Washington D.C.

Source: Econoday, September 27, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Lennar (LEN), Paychex (PAYX)

Thursday: Constellation Brands (STZ), Costco (COST), PepsiCo (PEP)

Source: Zacks, September 27, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.