The Weekly Update

Week of January 8, 2018

By Christopher T. Much, CFP®, AIF®

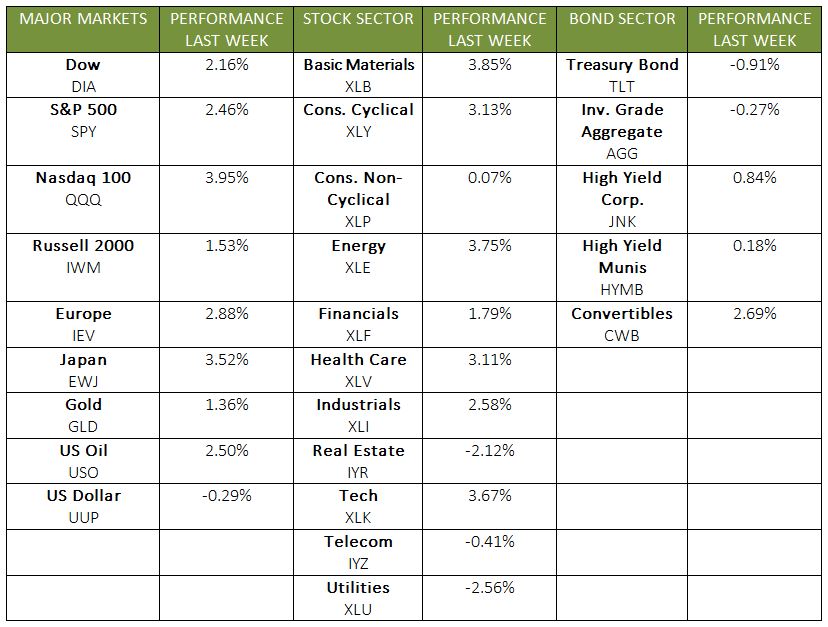

The first week of 2018 is behind us, and across the globe, stocks experienced a strong start to the year. International stocks in the MSCI EAFE gained 2.44% last week. In the U.S., our major indexes also leapt forward, reaching several records and milestones.

Domestic Index Performance for the First Week of 2018

S&P 500:

- Gained 2.60%

- Hit 2,700 for the first time

- Posted its largest weekly gain since December 2016

Dow:

- Gained 2.33%

- Hit 25,000 for the first time

- Had its best yearly start since 2006

NASDAQ:

- Gained 3.38%

- Hit 7,000 for the first time

- Posted its largest weekly gain since December 2016

- Had its best yearly start since 2006

What drove markets last week?

A variety of factors affected the markets last week—from tax reform to commodity prices. Interestingly, considering the indexes’ positive performance, one of the biggest economic headlines seemed to provide negative data: The U.S. economy added fewer jobs than anticipated.

On the surface, this report may seem like bad news for the economy. The missed projection, however, is likely less of a big deal than it appears at first. While hiring was lower than expected, wages picked up and the unemployment rate remained at 4.1%—the lowest rate since 2000.

Ultimately, this jobs report may be positive news for the markets. It shows that the economy is still adding jobs but not at a blistering pace. As a result, slower job growth could keep the Federal Reserve from raising interest rates too aggressively. Cleveland Fed President Loretta Mester said she believes, “We’re basically at maximum employment from the view of monetary policy.” She anticipates 3 to 4 rate increases this year. If the Fed continues with its gradual rate increases, this move could have a favorable effect on stocks.

As we move forward in 2018, we will continue monitoring a myriad of economic perspectives that may impact you, including any changes to monetary policy. For now, we are pleased to see the markets’ positive start to the year and look forward to guiding you through whatever lies ahead.

ECONOMIC CALENDAR

Tuesday: JOLTS

Thursday: Jobless Claims

Friday: Consumer Price Index, Retail Sales